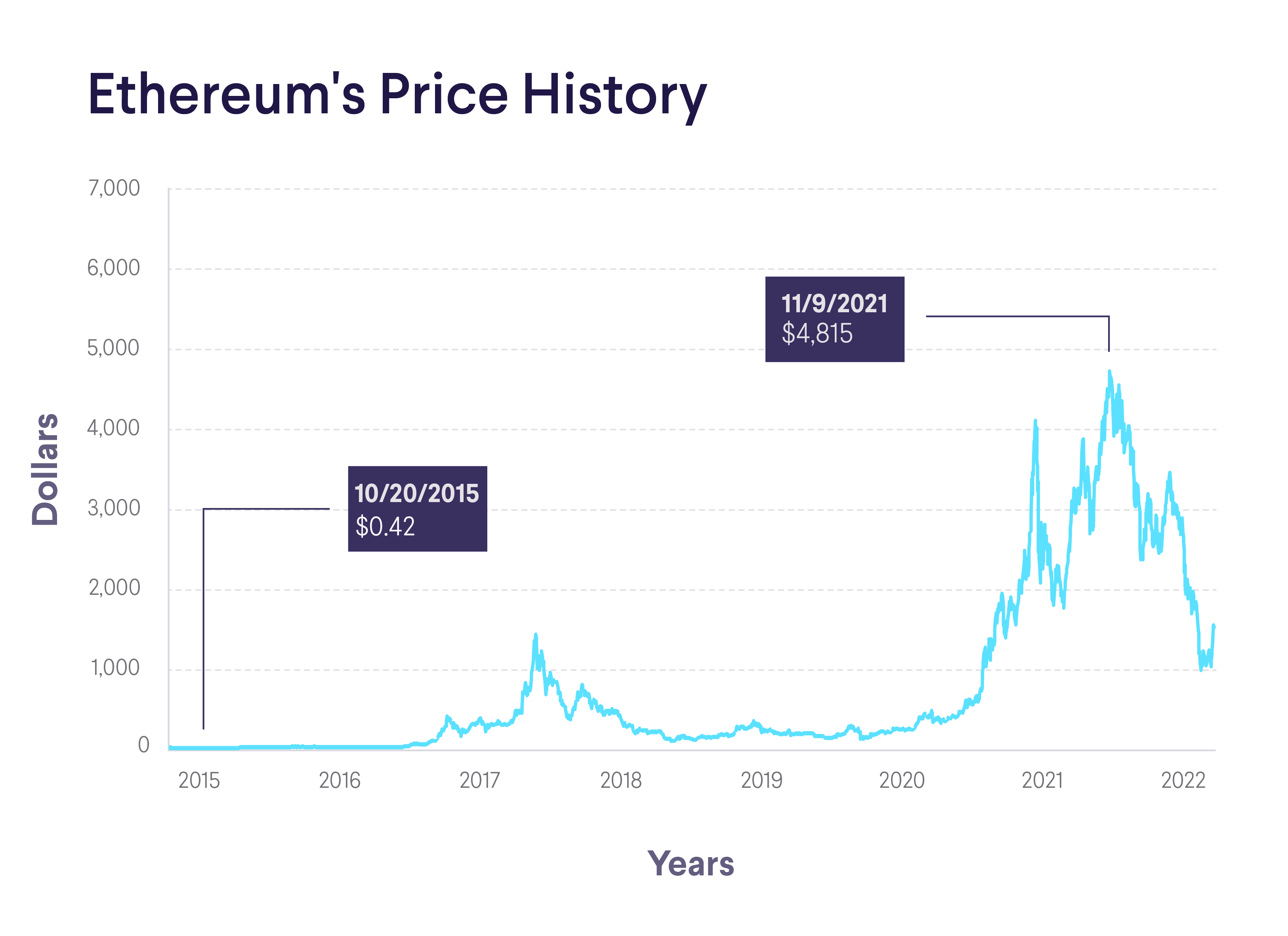

Ethereum is the second-largest cryptocurrency by market cap after Bitcoin, and it was the first to introduce blockchain-based smart contract technology. In part thanks to Ethereum’s many innovations, the value of ETH has been relatively high over the last seven or eight years — with a historic low of about 42 cents and an all-time high of about $4,800 in November of 2021.

The concept for the Ethereum platform was first proposed in a white paper by Vitalik Buterin in 2013. In 2014, he and a team of developers raised about $18 million to establish the nonprofit Ethereum Foundation and fund its development. The Ethereum platform launched in 2015.

From the beginning, the vision for Ethereum was distinct from Bitcoin or any other cryptocurrency at the time. The larger idea for Ethereum was to create a programmable blockchain that would enable a sort of free market environment, where developers could create applications and programs without any control or interference from a third party.

Table of Contents

Ethereum Price History

The innovative spirit of the Ethereum blockchain has sustained its value over the years.

Many blockchain-based projects have been built on the Ethereum network, including countless decentralized finance (DeFi) apps, non-fungible tokens (NFT), and a long list of utility tokens that serve various use cases.

The Ethereum Virtual Machine (EVM) powers these automated agreements.

When it was launched in 2015, the price of 1 ETH was under a dollar – starting at $0.74. In 2016, the cryptocurrency was listed on Coinbase and was trading between $7 – $10. By 2017, a volatile year, the price skyrocketed as high as $1,600 before falling by about 95%, to $80.

Over the next few years, ETH would eventually see another bull market, taking its price to a new all-time high of $4,815 in November 2021. Since then, the price has fallen again, and was trading around $1,124, as of November 9, 2022.

|

Ethereum (ETH) Price History |

||

|---|---|---|

| Year | High | Low |

| 2015 | $1.39 | $0.42 |

| 2016 | $21.25 | $0.93 |

| 2017 | $881.94 | $7.98 |

| 2018 | $1,119.37 | $82.83 |

| 2019 | $361.40 | $102.93 |

| 2020 | $533.00 | $95.18 |

| 2021 | $4,815.00 | $718.11 |

Ethereum Price in 2015: Starting Price

Price of Ethereum in 2015: $0.42 to $1.39

In 2015, the year that Ethereum first launched, the price started at around $0.74 and the lowest closing price for ETH was $0.42.

The year 2015 was the only time when Ethereum was worth one dollar or less, with the exception of January 2016.

There weren’t many significant events for the Ethereum price history in 2015. The network had only just been launched and the ETH token had little value.

Ethereum Price in 2016: First Hard Fork

Price of Ethereum in 2016: $0.93 to $21.25

Early 2016 was the last time that Ethereum was worth less than a dollar. The lowest price for ETH was in January, around $0.93. ETH climbed as high as $21.25 in June before falling back to $6 in December.

There were several significant Ethereum-related events that happened in 2016. Ethereum saw what was at the time the largest crowdfunding in history with its Decentralized Autonomous Organization (or DAO). The DAO was then hacked when attackers exploited an aspect of the crowdfunding mechanism inside a smart contract that allowed them to withdraw ETH from the fund.

As a result of this attack, Ethereum developers decided to hard fork the network. This allowed them to roll back the blockchain to a time when the DAO hack had never happened.

The original chain then became Ethereum Classic (ETC), and the new chain became Ethereum (ETH). This event is sometimes referred to as the ETC/ETH split.

In other important crypto news, ETH became the second-ever crypto to be listed on Coinbase in July of 2016. Up until that time, Coinbase users could only buy and sell Bitcoin. This helped set the stage for Ethereum’s massive bull run over the next few years.

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

Ethereum Price in 2017: Becoming Mainstream

Price of Ethereum in 2017: $7.98 to $881.94

In 2017, awareness of Ethereum began to grow, and the ETH price started to soar. The lowest price for ETH that year was just under $8, where it began in January. The ETH price then rose as high as $881.94 by December.

In 2017, the crypto asset class as a whole started going mainstream. Bitcoin rose from about $1,000 in early 2017 to as high as $19,000 by December 2017. Ethereum and many other altcoins came along for the ride, seeing even more dramatic price increases. During this time, ETH would solidify its place as the second-largest cryptocurrency by market cap, where it still sits today.

Ethereum Price in 2018: Breaking $1K

Price of Ethereum in 2018: $82.83 to $1,119.37

In 2018, Ethereum reached $1,119.37, the highest price it had ever been at the time. But by December, the lowest price for ETH was $82.83, as the infamous “crypto winter” set in, and many cryptocurrencies saw their values plummet by 90% or more.

While there weren’t many significant events pertaining to Ethereum specifically in 2018, there was a lot of FUD (fear, uncertainty, doubt) surrounding crypto in general at this time. Many media reports declared that Bitcoin and cryptocurrency were “dead” after the market shed hundreds of billions of dollars off its total market cap.

Just two years earlier, in 2016, the entire cryptocurrency market cap had been under $10 billion. At the peak in 2018, it topped out at $820 billion, representing a rise of more than 80x in just a few years as traders piled into a speculative mania that would go down in history as one of the biggest asset bubbles ever.

Ethereum Price in 2019: The Uneventful

Price of Ethereum in 2019: $102.93 to $361:40

The lowest price for Ethereum in 2019 was $102.93, more than 90% down from $1,432, the highest price Ethereum had ever been at that point in time.

There weren’t many significant events regarding the Ethereum price history in 2019. It wasn’t a very eventful year in crypto.

Ethereum Price in 2020: The Coronavirus Effect

Price of Ethereum in 2020: $95.18 to $533.00

Ethereum began 2020 at about $127, a price not far above where it began the previous year. Times were tough, owing to the pandemic. But ETH was able to find its footing toward the end of the year.

In Q1 2020, the coronavirus pandemic and associated lockdowns led to a worldwide sell-off across all asset classes. Crypto was no exception. Ethereum fell below $100 in March 2020 before climbing higher in the second half of that year. This set the stage for the epic bull run of 2021.

Ethereum Price in 2021: Epic Bull Run

Price of Ethereum in 2021: $718.11 to $4,780.73

The lowest price for ETH in 2021 was $718. This year saw the highest price Ethereum has ever been, at $4,815.00. This smashed the previous record high of over $1,400.

2021 saw a bull market in most asset classes, including stocks, bonds, real estate, and crypto. The total crypto market cap crossed $3 trillion for the first time that year. Ethereum was supposed to undergo an upgrade (called the Merge) in 2021, but it was pushed to September of 2022.

Ethereum Price in 2022

Price of Ethereum in 2022: $896 to $1,965

The lowest price for Ethereum in 2022 so far has been $896, while the high has been $1,965. The price is currently hovering around the $1,100 level, as of Nov. 9, 2022.

Owing in part to the economic crisis brewing in early 2022, thanks to inflation and rising interest rates, crypto valuations have plummeted in value this year. The stablecoin crisis in early Q2 didn’t help, as Terra and its linked crypto LUNA, crashed. As of Q4 of 2022, the crypto markets had lost billions in value, and 2022 has been dubbed the next crypto winter.

Even Ethereum’s successful migration from a proof-of-work system to a proof-of-stake network in September has not yet delivered additional price momentum — but at least it’s not as low as some of its competitors. The merge marks the end of traditional crypto mining as a way to generate new Ethereum tokens.

💡 Recommended: What Is Ethereum 2.0? How Will It Be Different?

Considerations When Investing in Ethereum

Cryptocurrencies are volatile, and many altcoins, including ETH, can be even more volatile than Bitcoin. This increases the chances for outsized gains as well as steep losses. When investing in ETH, it’s important to consider a project’s past and future. The DAO hack of 2016 resulted in the ETC/ETH split, something that interested investors may want to consider researching further.

Another important factor to consider is Ethereum’s “merge,” or upgrade from a proof-of-work consensus mechanism to a proof-of-stake one. While this evolution hasn’t yielded big gains, it’s possible that the greater energy efficiency across the Ethereum network could still yield unforeseen benefits.

The Takeaway

Ethereum is one of the oldest and most successful crypto networks. It has made the DeFi revolution possible, thanks to its development of smart contracts and other innovative uses of blockchain technology.

Still, there’s no getting around the fact that crypto prices are volatile. Ethereum price history is one of ups and downs, ground lost — and ground regained. Ethereum launched with a value of about 1 dollar in 2015 and early 2016, but since then the price has soared way beyond those levels.

A correction of almost 95% happened after Ethereum’s 2018 high of over $1,400, and a correction of over 80% occurred after the more recent 2021 high of over $4,800, the highest price Ethereum has ever been.

Photo credit: iStock/PeopleImages

SoFi Invest® INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , and the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

2Terms and conditions apply. Earn a bonus (as described below) when you open a new SoFi Digital Assets LLC account and buy at least $50 worth of any cryptocurrency within 7 days. The offer only applies to new crypto accounts, is limited to one per person, and expires on December 31, 2023. Once conditions are met and the account is opened, you will receive your bonus within 7 days. SoFi reserves the right to change or terminate the offer at any time without notice.

First Trade Amount

Bonus Payout

Low

High

$50

$99.99

$10

$100

$499.99

$15

$500

$4,999.99

$50

$5,000+

$100

SOIN0622001