If you’re thinking of applying for a $600K mortgage, here’s the bottom line: The monthly payment on this mortgage at a 7% annual percentage rate (APR) for 30 years works out to be $3,991.81.

If you would rather finance with a 15-year mortgage, the monthly payment would be $5,392.97.

A higher monthly payment on a 15-year mortgage term does cost more every month, but the savings over the life of the loan are huge. Interest costs for a 30-year loan exceed $830,000, while the interest costs on a 15-year loan are closer to $370,000. That’s quite a difference.

And, of course, interest rates are not static. The rates you are offered when you apply for a loan will vary over time. Just a short while ago, many borrowers would have access to an interest rate approximately half the current 7% figure. A 3.5% APR with the same $600K mortgage over 30 years would result in a monthly payment of $2,694.27. That’s the power interest rates have on your mortgage and monthly payment.

Keep reading to learn about all the costs involved on a $600,000 mortgage and how they affect your monthly payment.

Table of Contents

Key Points

• A $600,000 mortgage will have a monthly cost that includes principal, interest, property taxes, and homeowners insurance.

• The exact monthly cost will depend on factors such as interest rate, loan term, and location.

• Using a mortgage calculator can help estimate the monthly cost of a $600,000 mortgage.

• It’s important to consider other expenses, such as maintenance and utilities, when budgeting for homeownership.

• Working with a lender and getting pre-approved can provide a clearer picture of the monthly cost of a $600,000 mortgage.

Total Cost of a $600K Mortgage

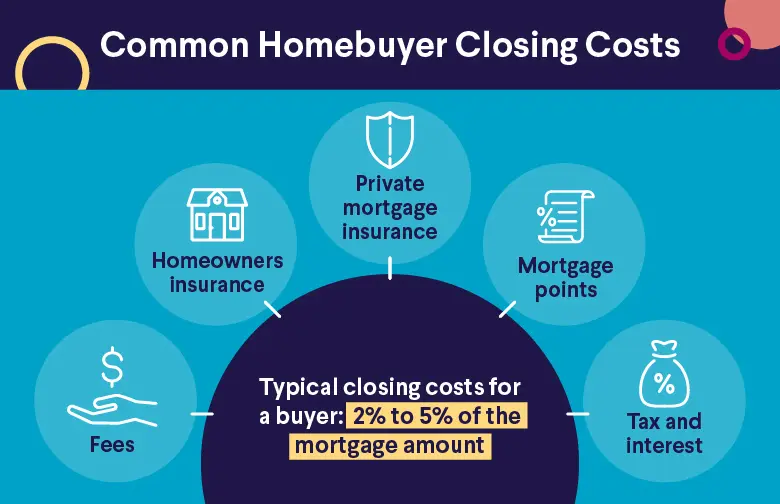

The cost of a $600K mortgage goes beyond the monthly payment. You’ll have upfront costs, like the down payment and closing costs, as well as the long-term interest costs.

Upfront Costs

When you acquire a mortgage, your upfront costs include your down payment and closing costs.

• Closing costs: Closing costs, or settlement costs, are what you pay to obtain the mortgage and property title. It varies, but you’ll usually pay for an appraisal, origination fee, prepaids, tax service provider fees, government taxes, and title insurance. The average closing cost on a new home is somewhere between 3% and 6%. For a $600,000 mortgage, that’s between $18,000 and $36,000.

• Down payment: According to the National Association of Realtors, the average down payment on a home is 13%. For a $600,000 home, that’s a $78,000 down payment. Other common down payments include:

• 3%: $18,000

• 3.5%: $21,000

• 5%: $30,000

• 20%: $120,000.

Recommended: Home Loan Help Center

Long-Term Costs

The long-term costs of a $600K mortgage are also important to consider. They’re considerable. If you pay on your $600K mortgage for all 30 years at that 7% APR, you’ll pay over $800,000 in interest costs alone, as mentioned above. For 15 years, that amount comes down to $370,000.

You can play around with our mortgage payment calculator if you’re interested in seeing the difference that APR and loan term make on a monthly payment.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

Estimated Monthly Payments of a $600K Mortgage

The monthly payments on a $600K mortgage can vary widely. How much house can you afford depends not only on the down payment but also the monthly payment you’re able to make. Your interest rate and loan term are important factors to consider.

Monthly Payment Breakdown by APR and Term

It’s helpful to see what your monthly payment would be based on different interest rates and loan terms for a $600K mortgage loan.

This chart can help you understand how mortgage APR works and impacts your costs.

| APR | Monthly Payment on a 15-Year Loan | Monthly Payment on a 30-Year Loan |

|---|---|---|

| 3.5% | $4,289.30 | $2,694.27 |

| 4% | $4,438.13 | $2,864.49 |

| 4.5% | $4,589.96 | $3,040.11 |

| 5% | $4,744.76 | $3,220.93 |

| 5.5% | $4,902.50 | $3,406.73 |

| 6% | $5,063.14 | $3,597.30 |

| 6.5% | $5,226.64 | $3,792.41 |

| 7% | $5,392.97 | $3,991.81 |

| 7.5% | $5,562.07 | $4,195.29 |

| 8% | $5,733.91 | $4,402.59 |

| 8.5% | $5,908.44 | $4,613.48 |

| 9% | $6,085.60 | $4,827.74 |

| 9.5% | $6,265.35 | $5,045.13 |

| 10% | $6,447.63 | $5,265.43 |

How Much Interest Is Accrued on a $600K Mortgage?

There’s another factor to consider when choosing a mortgage term for a $600K mortgage: the interest that will accrue.

If you pay the exact amount of your monthly payment on a $600K mortgage for an entire 30-year term with a 7% APR, you will pay $837,053 in interest. Adding in your $600K mortgage brings the total amount you will pay to $1,437,053.

A 15 vs. 30 year mortgage tells a different story when it comes to how much interest you pay. A 15-year loan on a $600K mortgage with a 7% interest rate has a larger monthly payment at $5,392.97, but the interest cost is $370,734.53. Compare that with the $837,053 interest costs of a 30-year loan, or $3,991.81 per month. In terms of total costs, the 15-year loan will add up to $970,734.53, while the 30-year mortgage equals $1,437,053 for principal plus interest.

$600K Mortgage Amortization Breakdown

We’ve already discussed how the total cost of a $600K mortgage is over 1.4 million dollars. When you look at how much of your monthly payment is applied to the principal loan amount (this is also called amortization), it’s easy to see how you end up paying so much in interest costs.

Amortization schedules are set so that more of your monthly payment goes toward interest than principal in the beginning. Toward the end of your loan, more of your monthly payment goes toward the principal amount of the loan.

Looking at the amortization schedule can help you see the full picture of what you’re paying on your $600K mortgage payment and perhaps choose which type of mortgage loan is best for you.

The amortization schedule below assumes a 7% interest rate over 30 years. The amount does not include insurance or taxes; it’s principal and interest for informational purposes only.

| Year | Mortgage Monthly Payment | Beginning Balance | Total Amount Paid for the Year | Interest Paid During the Year | Principal Paid During the Year | Ending Balance |

|---|---|---|---|---|---|---|

| 1 | $3,991.81 | $600,000.00 | $47,901.72 | $41,806.92 | $6,094.80 | $593,905.14 |

| 2 | $3,991.81 | $593,905.14 | $47,901.72 | $41,366.31 | $6,535.41 | $587,369.68 |

| 3 | $3,991.81 | $587,369.68 | $47,901.72 | $40,893.87 | $7,007.85 | $580,361.78 |

| 4 | $3,991.81 | $580,361.78 | $47,901.72 | $40,387.28 | $7,514.44 | $572,847.27 |

| 5 | $3,991.81 | $572,847.27 | $47,901.72 | $39,844.05 | $8,057.67 | $564,789.54 |

| 6 | $3,991.81 | $564,789.54 | $47,901.72 | $39,261.55 | $8,640.17 | $556,149.31 |

| 7 | $3,991.81 | $556,149.31 | $47,901.72 | $38,636.95 | $9,264.77 | $546,884.48 |

| 8 | $3,991.81 | $546,884.48 | $47,901.72 | $37,967.20 | $9,934.52 | $536,949.90 |

| 9 | $3,991.81 | $536,949.90 | $47,901.72 | $37,249.02 | $10,652.70 | $526,297.14 |

| 10 | $3,991.81 | $526,297.14 | $47,901.72 | $36,478.93 | $11,422.79 | $514,874.30 |

| 11 | $3,991.81 | $514,874.30 | $47,901.72 | $35,653.19 | $12,248.53 | $502,625.70 |

| 12 | $3,991.81 | $502,625.70 | $47,901.72 | $34,767.72 | $13,134.00 | $489,491.64 |

| 13 | $3,991.81 | $489,491.64 | $47,901.72 | $33,818.26 | $14,083.46 | $475,408.13 |

| 14 | $3,991.81 | $475,408.13 | $47,901.72 | $32,800.16 | $15,101.56 | $460,306.51 |

| 15 | $3,991.81 | $460,306.51 | $47,901.72 | $31,708.46 | $16,193.26 | $444,113.20 |

| 16 | $3,991.81 | $444,113.20 | $47,901.72 | $30,537.86 | $17,363.86 | $426,749.27 |

| 17 | $3,991.81 | $426,749.27 | $47,901.72 | $29,282.62 | $18,619.10 | $408,130.10 |

| 18 | $3,991.81 | $408,130.10 | $47,901.72 | $27,936.62 | $19,965.10 | $388,164.95 |

| 19 | $3,991.81 | $388,164.95 | $47,901.72 | $26,493.36 | $21,408.36 | $366,756.52 |

| 20 | $3,991.81 | $366,756.52 | $47,901.72 | $24,945.74 | $22,955.98 | $343,800.47 |

| 21 | $3,991.81 | $343,800.47 | $47,901.72 | $23,286.23 | $24,615.49 | $319,184.93 |

| 22 | $3,991.81 | $319,184.93 | $47,901.72 | $21,506.78 | $26,394.94 | $292,789.92 |

| 23 | $3,991.81 | $292,789.92 | $47,901.72 | $19,598.68 | $28,303.04 | $264,486.82 |

| 24 | $3,991.81 | $264,486.82 | $47,901.72 | $17,552.64 | $30,349.08 | $234,137.69 |

| 25 | $3,991.81 | $234,137.69 | $47,901.72 | $15,358.69 | $32,543.03 | $201,594.61 |

| 26 | $3,991.81 | $201,594.61 | $47,901.72 | $13,006.17 | $34,895.55 | $166,699.00 |

| 27 | $3,991.81 | $166,699.00 | $47,901.72 | $10,483.54 | $37,418.18 | $129,280.77 |

| 28 | $3,991.81 | $129,280.77 | $47,901.72 | $7,778.60 | $40,123.12 | $89,157.58 |

| 29 | $3,991.81 | $89,157.58 | $47,901.72 | $4,878.09 | $43,023.63 | $46,133.89 |

| 30 | $3,991.81 | $46,133.89 | $47,901.72 | $1,767.90 | $46,133.82 | $0 |

What Is Required to Get a $600K Mortgage?

You need to have an income sufficient to afford the monthly payments on a $600K mortgage.

Lenders generally look for your monthly payment to be no more than 28% of your gross income. For a $600K mortgage with a $3,991.81 payment, you would need to make $14,256 per month, or $171,077 per year (without any debt) to comfortably afford the mortgage payment.

Other factors, such as your credit score, will likely come into play as well in getting approved for a $600K mortgage.

How Much House Can You Afford Quiz

Recommended: First-Time Homebuyer Guide

The Takeaway

A $600k mortgage payment at 7% for 30 years would be $3992 per month. When you’re budgeting for a mortgage, it’s smart to consider all the costs, including the monthly payment and what a smaller monthly payment means for your long-term costs. Deciding whether to pay more each month and less over the life of the loan or vice versa can have a significant impact on your financial outlook and how you grow your personal wealth.

When you’re ready to take the next step toward a mortgage, consider what SoFi has to offer. With competitive interest rates, flexible loan terms, and a simple application process, your $600K mortgage could become a reality.

FAQ

How much would a $600,000 mortgage cost per month?

A monthly payment on a $600K mortgage at 7% APR would be $3,991.81. This is the amount of principal and interest and does not include the escrowed amounts.

What is the average monthly payment on a 500k mortgage?

A monthly payment on a 500K mortgage would be $3,326.51 on a 30-year term with a 7% APR.

How much do you need to make a year to afford a $500,000 home?

A 30-year $500,000 loan with a 7% APR boils down to a $3,326.51 monthly payment. For $3,326.51 to meet the 28% income guideline for lenders, you would need to make $11,880 a month, or about $142,560 per year. And this amount is only possible if you have no other debts.

Photo credit: iStock/FabioBalbi

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL0323010