The monthly amount that you pay on a mortgage for $700,000 covers the principal payment and interest, and your exact payment depends on several variables, including your interest rate. A $700,000, 30-year mortgage with a 6.00% interest rate, for example, costs around $4,200 monthly. However, there may be additional costs that you have to pay throughout the life of the loan, not to mention upfront costs that you must pay when you first close on the home.

The monthly cost of a mortgage depends on the interest rate, the length of the loan, and any additional costs, such as private mortgage insurance (PMI) charged on some loans. Mortgage loan terms are typically from 15 years to 30 years, and the monthly payments for a 15-year loan can be much higher than the payments for a 30-year loan, although, over its lifetime, the 30-year mortgage is typically more costly because interest costs are higher.

Here’s a look at how much a $700,000 mortgage might cost per month for a 15-year or 30-year loan term with various interest rates.

Table of Contents

Key Points

• The monthly cost of a $700,000 mortgage depends on factors like interest rate, loan term, and down payment.

• Using a mortgage calculator can help you estimate monthly payments and determine affordability.

• Factors like property taxes, homeowners insurance, and private mortgage insurance (PMI) can also affect the overall cost.

• It’s important to consider your budget and financial goals when determining the affordability of a mortgage.

• Working with a lender or mortgage professional can provide personalized guidance and help you understand the costs involved.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

What Is the Total Cost of a $700K Mortgage?

A $700,000 30-year mortgage with a 6.00% interest rate (which, as noted above, costs around $4,200 monthly) has a total cost of $1,510,867. The same loan over 15 years would have a $5,907 monthly payment and a total cost of $1,063,260. These amounts are simply estimates; exact costs will depend on interest, escrow, taxes, and insurance. A rule of thumb when buying a home is to not pay more than 28% of your gross monthly income. So someone whose monthly mortgage payment is $4,200 would need to take home at least $15,000 a month.

💡 Quick Tip: Buying a home shouldn’t be aggravating. SoFi’s online mortgage application is quick and simple, with dedicated Mortgage Loan Officers to guide you through the process.

The Upfront Costs of a $700K Mortgage

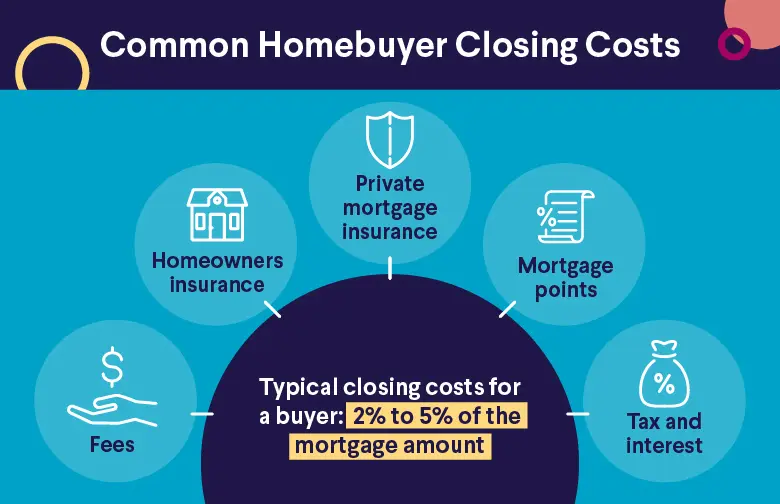

When you buy a house and take out a mortgage, in addition to your down payment, you will have to pay closing costs. Closing costs are mostly the administrative expenses for closing the deal. They include mortgage lender fees, titling fees, insurance fees, taxes, and appraisal fees. These costs are typically not covered by your down payment. Here’s a closer look at some upfront costs a buyer will face.

Earnest money Also known as a deposit, this is the money you put down to show the seller you’re serious about buying their place.

Down payment The amount you pay as a down payment will depend on the type of home loan. A conventional loan without private mortgage insurance (PMI) may call for a 20% down payment. On the other hand, you might get a conventional loan with mortgage insurance with a 3% down payment. A down payment for a Federal Housing Administration loan is typically around 3.5%, and Veterans Affairs loans or U.S. Department of Agriculture loans require no down payment.

The more you can afford as a down payment, the less interest you will pay because the lender considers you less risky as a borrower.

Closing costs Your lender will charge you fees for administrative services, such as application, origination, and underwriting fees. And then there are transfer taxes associated with transferring the title from the seller to the buyer.

Recommended: First-Time Homebuyer Guide

The Long-Term Costs of a $700K Mortgage

Your mortgage payments pay down the principal and the interest on your loan. Proportionally, more of your payment will go toward interest rather than the principal at the beginning of the loan term, and at the end of the loan term, more of your payment will go toward paying down the principal.

If you paid less than 20 percent as a down payment, your mortgage lender may also require you to pay private mortgage insurance (PMI) on a monthly basis. However, there are also other long-term costs:

Property taxes These can add up to thousands of dollars a year and can change annually, or as often as your town raises taxes.

Home maintenance One rule of thumb is to set aside 1% of your home’s total value each year for maintenance costs.

HOA, condo, or co-op fees If your home is a condo or part of a homeowners association (HOA) or co-op, you will need to pay a monthly fee. The fee covers services such as grounds maintenance, use of a community center, and snow removal. HOA fees can range anywhere from $100 to $1,000 or more.

Homeowners’ and hazard insurance Some areas are designated “high risk” for natural disasters, such as floods, earthquakes, wildfires, or severe storms. If your home is located in one of these areas, you will need to pay hazard insurance, which costs on average $2,110 per year, though prices vary, based on location and other factors.

Recommended: Home Loan Help Center

Estimated Monthly Payments on a $700K Mortgage

Mortgage loan terms have a big impact on your monthly payment amount. The table below shows the estimated monthly payments for a $700,000 mortgage loan for both a 15-year and a 30-year loan with interest rates varying from 6% to 8%.

| Interest rate | 15-year term | 30-year term |

|---|---|---|

| 6% | $5,907 | $4,197 |

| 6.5% | $6,098 | $4,424 |

| 7% | $6,292 | $4,657 |

| 7.5% | $6,489 | $4,895 |

| 8% | $6,690 | $5,136 |

How Much Interest Is Accrued on a $700K Mortgage?

The amount of interest accrued on a $700,000 mortgage will depend on the length of the loan and the interest rate. A shorter loan term will mean less accrued interest. For example, for a 15-year loan for $700,000 with a 6.00% interest rate, the interest would amount to around $363,260 over the life of the loan. For a 30-year loan with a 6.00% interest rate, the interest would be more than double at $810,867.

Amortization Breakdown for a $700K Mortgage

An amortization schedule for a mortgage loan tells you when your last payment will be and how much of your monthly payment goes toward paying off the principal and how much goes toward paying off the interest. At the beginning of the loan term, most of your payment will go toward the interest.

Below is the mortgage amortization breakdown for a $700,000 mortgage with a 6.00% interest rate for a 30-year loan.

| Year | Beginning balance | Interest paid | Principal paid | Ending balance |

|---|---|---|---|---|

| 1 | $700,000.00 | $8,596.08 | $41,766.16 | $691,403.92 |

| 2 | $691,403.92 | $9,126.27 | $41,235.97 | $682,277.65 |

| 3 | $682,277.65 | $9,689.16 | $40,673.09 | $672,588.49 |

| 4 | $672,588.49 | $10,286.76 | $40,075.48 | $662,301.73 |

| 5 | $662,301.73 | $10,921.23 | $39,441.02 | $651,380.50 |

| 6 | $651,380.50 | $11,594.83 | $38,767.42 | $639,785.67 |

| 7 | $639,785.67 | $12,309.97 | $38,052.27 | $627,475.70 |

| 8 | $627,475.70 | $13,069.22 | $37,293.02 | $614,406.48 |

| 9 | $614,406.48 | $13,875.30 | $36,486.94 | $600,531.18 |

| 10 | $600,531.18 | $14,731.10 | $35,631.14 | $585,800.07 |

| 11 | $585,800.07 | $15,639.68 | $34,722.56 | $570,160.39 |

| 12 | $570,160.39 | $16,604.30 | $33,757.94 | $553,556.09 |

| 13 | $553,556.09 | $17,628.42 | $32,733.82 | $535,927.66 |

| 14 | $535,927.66 | $18,715.70 | $31,646.54 | $517,211.96 |

| 15 | $517,211.96 | $19,870.05 | $30,492.20 | $497,341.91 |

| 16 | $497,341.91 | $21,095.59 | $29,266.65 | $476,246.32 |

| 17 | $476,246.32 | $22,396.72 | $27,965.52 | $453,849.60 |

| 18 | $453,849.60 | $23,778.10 | $26,584.14 | $430,071.50 |

| 19 | $430,071.50 | $25,244.68 | $25,117.56 | $404,826.82 |

| 20 | $404,826.82 | $26,801.72 | $23,560.53 | $378,025.10 |

| 21 | $378,025.10 | $28,454.79 | $21,907.46 | $349,570.31 |

| 22 | $349,570.31 | $30,209.82 | $20,152.43 | $319,360.50 |

| 23 | $319,360.50 | $32,073.09 | $18,289.15 | $287,287.40 |

| 24 | $287,287.40 | $34,051.29 | $16,310.95 | $253,236.11 |

| 25 | $253,236.11 | $36,151.50 | $14,210.74 | $217,084.61 |

| 26 | $217,084.61 | $38,381.25 | $11,981.00 | $178,703.36 |

| 27 | $178,703.36 | $40,748.52 | $9,613.73 | $137,954.85 |

| 28 | $137,954.85 | $43,261.80 | $7,100.45 | $94,693.05 |

| 29 | $94,693.05 | $45,930.09 | $4,432.15 | $48,762.96 |

| 30 | $48,762.96 | $48,762.96 | $1,599.29 | $0.00 |

What Is Required to Get a $700K Mortgage?

Let’s say you want to buy a home for $875,000 with a down payment of 20% or $175,000. To qualify for a 30-year mortgage loan of $700,000 with a 6.00% interest rate, you would need to earn around $180,000 annually. For a 15-year loan, you would need to earn around $253,000 annually.

This calculator shows you how much of a mortgage you can afford based on your gross annual income, your monthly spending, your down payment, and the interest rate.

How Much House Can You Afford Quiz

The Takeaway

When you’re calculating how much a mortgage loan for $700,000 will cost per month, the principal and interest are two of the biggest components. The length of the loan will drastically affect the amount of interest paid over the life of the loan. For example, the interest paid on a 30-year loan versus a 15-year loan with a 6.00% interest rate could be more than double.

Bear in mind also that there are other costs that may be included, such as private mortgage insurance. And don’t forget about closing costs as well.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

What will the monthly payments be for a $700K mortgage?

The longer your loan term, the lower your monthly payment on a mortgage loan, but you will pay more interest over the life of the loan. The exact monthly payment for a $700,000 mortgage will depend on the interest rate and the loan term. The payment for a $700,000 30-year mortgage with a 6.00% interest rate is approximately $4,200. For a 15-year loan with the same interest rate, the monthly payment is around $5,900.

How much do I need to earn to afford a $700K mortgage loan?

To buy a home for $875,000 with a down payment of 20% or 175K, and with a 30-year mortgage loan of $700,000 with a 6.00% interest rate, you would need to earn around $180,000 annually. For a 15-year loan, you would need to earn around $253,000 annually.

How much down payment is required for a $700K mortgage loan?

The down payment you will pay will depend on the type of mortgage and the lender. Some lenders accept 3%, while some expect 20%. If your down payment is less than 20%, you might have to add private mortgage insurance (PMI) to your monthly payments.

Photo credit: iStock/Xacto SoFi Loan Products SoFi Mortgages

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

†Veterans, Service members, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veterans Affairs. VA loans are subject to unique terms and conditions established by VA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. VA loans typically require a one-time funding fee except as may be exempted by VA guidelines. The fee may be financed or paid at closing. The amount of the fee depends on the type of loan, the total amount of the loan, and, depending on loan type, prior use of VA eligibility and down payment amount. The VA funding fee is typically non-refundable. SoFi is not affiliated with any government agency.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL-Q225-046