It’s not your imagination: America is pet-crazy. Two out of three households have a pet, and as the holidays roll in, these furbabies are increasingly part of the planning.

Perhaps they occupy the center of the holiday card (wearing a cute Xmas sweater… or an ugly one), travel with their pet parent to Grandma’s house, or receive a pile of presents.

Consider these pet spending statistics: Last year, consumers spent almost $137 billion year-round on their animals, an increase of 11% year over year. Could this spending soar still higher as the winter holidays unfold?

To learn more about this trend, SoFi surveyed 1,200 pet-owning adults from coast to coast in October 2023. Here, you’ll learn more about how animals are making the season more magical and memorable… and how they are being gifted with holiday goodies.

For starters, did you know the following pet spending statistics?

• 70% of people typically buy their pets gifts. Of those, more than a quarter (27%) spend more than $100 on gifts.

• 89% plan to dip into their wallet in some way to maximize their pets’ holiday joy.

Read on to learn the full story on pet owners’ habits and their holiday spending statistics. You may be surprised!

Holiday Joy: Pets Play a Major Role

The holidays are all about togetherness, whether that means watching a game, baking holiday treats, or watching “A Charlie Brown Christmas” on heavy repeat. But SoFi’s survey revealed that people love sharing the season with their pets.

In fact, more than one in four respondents (27%) say they can’t stand the idea of spending the holiday season without their pet by their side. If they can’t take their four-legged friend with them, over the river and through the woods, they might even wish they could just stay home!

So, how do pet owners celebrate the holidays with their pets? Besides getting them gifts, including pets in holiday photos is a popular choice for many (58%), as is putting up decorations, such as stockings, personalized for their pet (47%).

“Why include pets in holiday traditions? It’s simple — these traditions create bonding moments,” says Chris Allen, founder of Oodle Life, a pet blog . “One year, Max actually unwrapped his own gift, a squeaky toy, and the joy on his face was priceless. It not only made our day but also made us feel more connected as a family, furbaby included.”

Here’s are respondents’ favorite ways to include pets in their holiday celebrations:

• 70% get holiday pet gifts.

• 58% include pets in their holiday photos.

• 47% have personalized holiday decor for their pet (such as a stocking or ornament).

• 45% make a special holiday meal for their pet.

• 40% dress up their pets in holiday attire (such as sweaters and hats).

• 40% let their pet be a taste-tester when cooking or baking holiday meals.

• 30% take their pets to holiday events.

• 28% bake holiday treats for their pets.

It just may be that the pet owners who forgo gifts for their critters are taking the extra time to bake holiday biscuits for them.

Including pets can help bond a family. “Our furry friends are integral family members, and holidays just aren’t complete without their spirited participation,” says Dr. Mollie Newton, DVM, founder of pet care resource site, PetMeTwice, “My own whiskered sidekick has his own stocking, which hangs proudly beside the family’s every December.”

Pets Dress the Part for the Holidays

Is there anything cuter than a grumpy cat in a Santa hat? Or a pooch dressed up to look like Max from “How the Grinch Stole Christmas?” Not really! And when pet people party, you can bet most will deck their pet out in special garb: 68% dress up their pet for holiday celebrations.

So let’s take a closer look at exactly how pet people like to deck out their dogs, felines, and other beloved pets for the holidays.

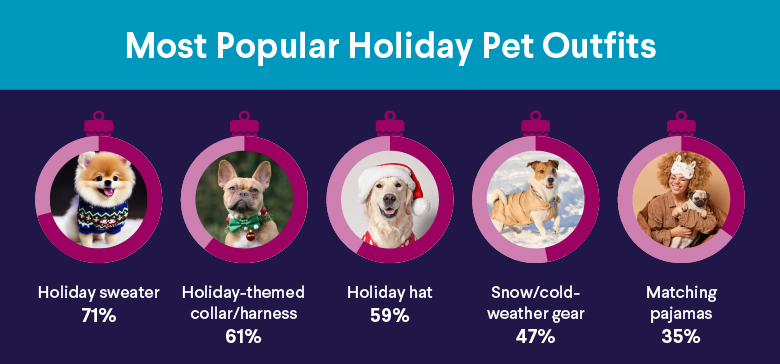

Of the pet owners who dress up their pets, here are the most popular ‘fits:

• 71% bought their pet a holiday sweater.

• 61% put a holiday-themed collar/harness on their pet during the holidays.

• 59% made their pet wear a holiday hat (think Santa hats, antlers, and elf ears).

• 47% bought their pet snow and cold-weather gear (such as snow jackets or boots).

• 35% bought themselves and their pet matching pajamas.

“Every Christmas, we put a little reindeer antler headband or Santa hat on our Labradoodle, Max,” says Oodle Life’s Allen, “He struts around, and it’s like he knows he’s the center of attention!”

What better way, after all, to prepare for a pet family’s holiday photo than donning matching hats or pajamas!

Pet Owners Go Big for Holiday Gifts

The vast majority of pet owners will likely go holiday gift shopping for their furry companion, and we wouldn’t be surprised if they wrapped the present and put it under the tree. After all, owners want pets’ holidays to be jolly and joyful, too.

About those presents: Many of these aren’t just random impulse purchases. Nearly half of pet owners (46%) say their pet has a holiday wish list. And almost one in five (18%) say their pet’s list is longer than their own!

The SoFi survey revealed that 70% of people typically buy their pets gifts. Wondering how much people spend on their pets? Consider this: Of those who dip into their wallets, more than a quarter (27%) spend more than $100. Talk about pampered pets! This year, 75% of pet owners plan to buy their pets gifts, so the numbers appear to be growing.

Overall, two key factors are likely to impact how much people spend on pets: their earning power and whether or not they have kids.

Household Income Plays a Bigger Role in Pet Gifting

According to SoFi’s research, the more financial means a person has, the more likely they are to go big on gifts for their pets. Perhaps if they are used to buying themselves more luxurious items, they may be more inclined to do the same for their animal. There are designer dog clothes, for instance, costing hundreds of dollars per garment.

In short, as income rises, so too does spending on gifts for our furry friends:

• 42% of respondents with a household income of $100,000 and up spend more than $100 on pet gifts.

• Only 12% of respondents with a household income under $100,000 spend more than $100 on pet gifts.

39% of Dual-Income Families With Kids Plunk Down $100+ on Pet Presents

Among pet owners, you might think that dual income families who don’t have kids would spend the most, overall, on holiday gifts for their pets. Think again. The SoFi survey uncovered surprising stats on pet gifting:

Dual-income families with kids actually spend more on pet gifts than those families with no kids.

• 39% of dual-income families with kids spend more than $100 on pet gifts.

• 21% of dual-income families with no kids (DINKs) spend more than $100 on pet gifts.

Perhaps seeing how much joy pets bring kids has an impact: It might encourage parents to dip into their wallets more deeply.

Overall, Families With Kids Spend More on Their Pets

Nearly everyone aims to celebrate the holidays affordably, but a much-loved pet may encourage people to spend more freely during the festive season.

More than eight out of 10 (82%) pet owners spend at least $25 more than usual on their pets during the holidays. Some spend still more freely, with 34% of SoFi survey respondents doling out at least $100 more than their norm.

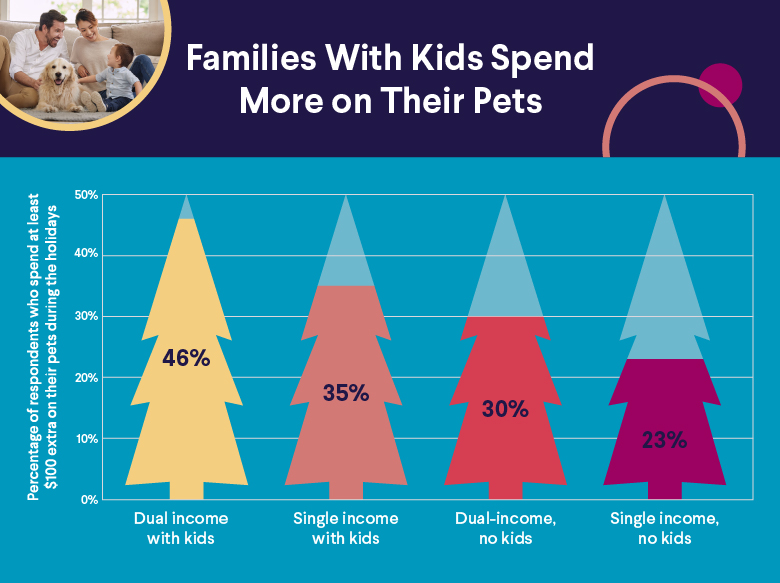

Just as kids inspire families to splurge on pet gifts, they also appear to inspire holiday pet spending overall.

Pet owners with kids tend to spend more on their pets during the holidays:

• 46% of dual-income families with kids spend at least $100 more.

• 35% of single-income families with kids spend at least $100 more.

• 30% of dual-income, no kids households (DINKS) spend at least $100 more.

• 23% of single-income, no kids households spend at least $100 more.

While 43% of pet owners say: “My pet is spoiled so I splurge on them during the holidays,” it probably comes as no surprise that those with kids say this most often:

• 78% of families with kids agree with this statement.

• 22% of families with no kids relate to this statement.

Nearly Half Budget Ahead of Time for Holiday Pet Spending

When the holidays approach, many pet parents assess how much they have to spend for the holidays. Whatever type of budget they use, there’s a good chance it includes funds to make the season special for their animals.

Interestingly, nearly half know how much they will spend on their pets for the holidays and sock that money away in advance — that’s good financial planning in action. Here are the details:

• 49% say “Yes, I know how much I’ll spend on my pets and put that money aside for holiday spending.”

• 51% say “No, I don’t plan for how much I’ll spend on my pet during the holidays.”

Note: No word on how much pets are planning to spend on their parents….

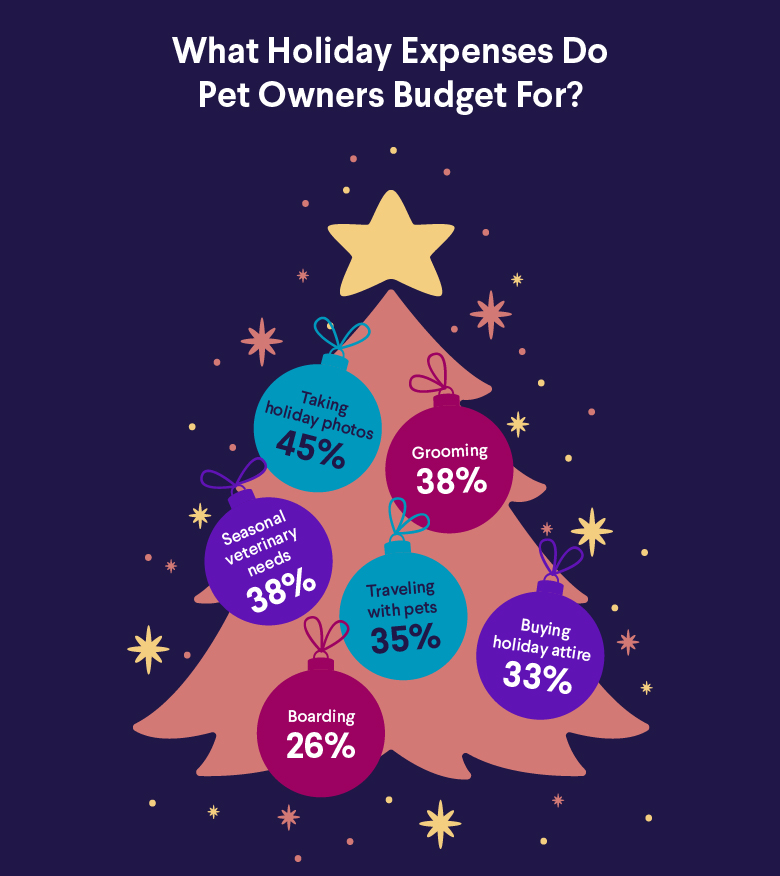

Generally, pet parents take a number of different pet-related costs into consideration during the holidays. It’s not just about squeaky toys and catnip, after all. It’s about photos with, say, Molly, the beloved guinea pig, front and center. Yes, nearly half of our respondents budget for holiday photos with their pet. And more than one out of three pet owners account for the cost of getting their pet groomed for the season. Got to look sleek for those pictures, right?

Take a closer look at where the dollars go. Aside from holiday gifts, pet owners told SoFi that they plan for the following costs:

• 45% budget for taking holiday photos.

• 38% budget for getting their pet groomed for the holidays.

• 38% budget for seasonal veterinary needs.

• 35% budget for bringing their pets along when they travel for the holidays.

• 33% budget for buying holiday attire for their pet(s).

• 26% budget for boarding or care for pets because they’re booking holiday travel without their animal.

How to Spoil Your Pet… Without the Debt

Just because many SoFi survey respondents may spend lavishly on their pets over the holidays (as many Americans do), that doesn’t mean they abandon their financial savvy and become bad with money. They apply the same money-smart tactics for their pet purchases as they do for their own gear. Coupon clipping? Check. Signing up for emails that might bring rewards? You bet.

Here’s how they make the most of their cash during the holidays:

• 62% say they use coupons to help save money on holiday spending for their pets.

• 48% say they subscribe to pet company marketing emails to scan for deals.

• 40% get money-saving tips from friends and family.

• 24% say they follow influencer recommendations (yes, petfluencers can really have pull).

Recommended: How to Make a Budget: A Beginner’s Guide

Sometimes Naughty, Always Loved

Much as people adore their kitties, rabbits, and dogs, let’s face it: The answer to “Who’s a good boy?” is not always “You are!” Pets can be rascals — chewing shoes, shredding upholstery to ribbons, and leaving muddy pawprints.

Indeed, while many pet parents will be rewarding their good boys (and girls) this season, not all critters may deserve their gifts.

In fact, 22% of pet owners surveyed by SoFi say they’d put their pet on the naughty list.

What’s more, the holiday season gives animals ample occasion to run wild. You know the drill: cats deciding to climb the Christmas tree, or a dog dragging lovingly prepared food off the table (Remember how “A Christmas Story” ended?).

Here’s what the SoFi survey respondents had to say on this aspect of the holidays with pets.

What do pet owners dread most during the holidays?

• 37% of respondents say it’s their pet knocking over the Christmas tree or knocking ornaments off the tree.

• 27% say it’s their pet tearing open gifts early.

• 26% say it’s their pet stealing food from the table or counter.

• 24% say it’s their pet misbehaving around family and friends at gatherings.

• 17% say it’s untangling their pet from holiday lights.

Holiday Pet Safety Also a Concern

Amid all the revelry, pet parents are also focused on keeping their animals safe. After all, most people know facts like poinsettia being mildly toxic to dogs. Here’s how SoFi survey respondents feel about protecting their critters, because happy holiday pets are healthy holiday pets.

Almost one in four (23%) worry about needing to use pet-safe holiday decorations. The same percentage fear their pooch might get sick because friends and family overfeed them or slip them slices of forbidden foods just because, hey, it’s the holidays.

Here’s another source of anxiety for pet parents: being separated from their animal companion during the season. Nearly one-third of them worry about having to travel without their pet. They want to make sure wherever they are over the holidays, they have their furbaby right by their side… or in their lap.

“Involving our pets in our holiday celebrations helps us all feel a little more connected during the holiday seasons,” says Devin Stagg, Marketing Manager at dog-training provider, Pupford. “While I think they enjoy the treats and toys, I believe the greatest benefit is to the pup parent!”

Recommended: Tips to Cut Costs When Traveling With Pets

Pets Inspire the Spirit of Giving

If anyone needs further proof that pets are really and truly part of the family, take note. Pets have a way of inspiring gift giving across the generations. Few can resist giving them a little treat, whether that’s a fancy organic dog biscuit or a cat teaser.

According to SoFi’s survey, among families with children, 61% say their kids give gifts to the pet. And grandparents love their grand-furbabies, with almost one in three putting a pet present under the tree.

Pets themselves are often a favorite gift, too: 39% of pet owners say they’ve given someone else a pet as a holiday gift. Of those, 36% say they spent more than $100 on the pet, and 5% say they spent more than $1,000.

Takeaway

It’s no secret that Americans love their pets, and so when the holidays roll around, those animals get lavished with love, gifts, and special treatment. SoFi’s survey of 1,200 pet owners in October 2023 uncovered just how much people splurge on their furbabies, what they buy, why, and how pets can leave their imprint (or pawprint) on the holiday season.

When budgeting for the holidays — whether shopping for people, pets, or any other seasonal expense — having the right banking partner can make a difference. A solid financial institution can help give you the tools to make the most of your money.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOBK1023025