How and When to Combine Federal Student Loans & Private Loans

One of the biggest student loan myths is that borrowers can’t combine federal student loans and private student loans into one refinanced loan.

It’s understandable why people may think that, since this wasn’t always an option. And consolidation through the Department of Education is only available for federal student loans.

But now you can choose to combine federal and private loans. So it’s important to learn whether combining them is right for you, and if it is, how to consolidate private and federal student loans.

Table of Contents

Key Points

• Borrowers can now combine federal and private student loans through refinancing, which simplifies payments and may result in lower interest rates.

• Refinancing federal loans with a private lender results in the loss of federal benefits, such as forgiveness programs and income-driven repayment plans.

• Interest rates for federal student loans are fixed and determined annually, while private loans may offer lower rates based on creditworthiness and income.

• Federal student loans offer various benefits, including deferment and forbearance options, which are not available once loans are refinanced as private loans.

• Evaluating financial goals and loan details is essential before deciding to refinance, as it can impact payment terms and overall debt costs.

Can I Consolidate Federal and Private Student Loans?

If you’ve ever wondered, can I consolidate federal and private student loans?, the answer is yes. You can combine private and federal student loans by refinancing them with a private lender.

Through this process, you apply for a new loan (which is used to pay off your original loans) and obtain one with a new — ideally lower — interest rate.

Although you are combining your loans, refinancing isn’t the same thing as federal student loan consolidation.

Key Differences Between Consolidation and Refinancing

Some people use the words “refinance” and “consolidate” interchangeably, but consolidating student loans is a different process than refinancing student loans.

Federal student loans can be consolidated into one loan by taking out a Direct Consolidation Loan from the government. To be eligible for a Direct Consolidation Loan you must have at least one Direct Loan or one Federal Family Education Loan (FFEL). Federal loan consolidation does not typically lower your interest rate. The new student loan consolidation rate is the weighted average of the interest rates of your prior loans, rounded up to the nearest ⅛ of a percent.

You can only consolidate federal student loans in this way. Private student loans are not eligible for federal loan consolidation.

When you refinance student loans, you exchange your old student loans for a new private loan. You can refinance private student loans, federal student loans, or a combination of both types. When you refinance, you may be able to get a lower interest rate, which could help you save money on interest over the life of the loan, or more favorable loan terms, if you qualify.

However, refinancing federal loans makes them ineligible for federal benefits such as deferment and income-driven-repayment plans.

Pros and Cons of Combining Federal and Private Loans

Before you combine federal and private student loans, there are a number of things to think about. Consider the following advantages and drawbacks.

Pros:

• Combining federal and private loans may result in a lower interest rate if you qualify, which could help you save on interest over the life of the loan.

• You may be able to lower your monthly payments through refinancing by extending the term of your loan.

• Combining your loans can help you manage and streamline your payments since you’ll have just one loan rather than several.

Cons:

• Combining federal and private loans through refinancing means you’ll lose federal protections like forgiveness and deferment.

• In order to get lower interest rates, you’ll need a good credit score, a stable job, and a steady income.

• If you extend the term of the loan to lower your monthly payments, you’ll pay more interest over the life of the loan.

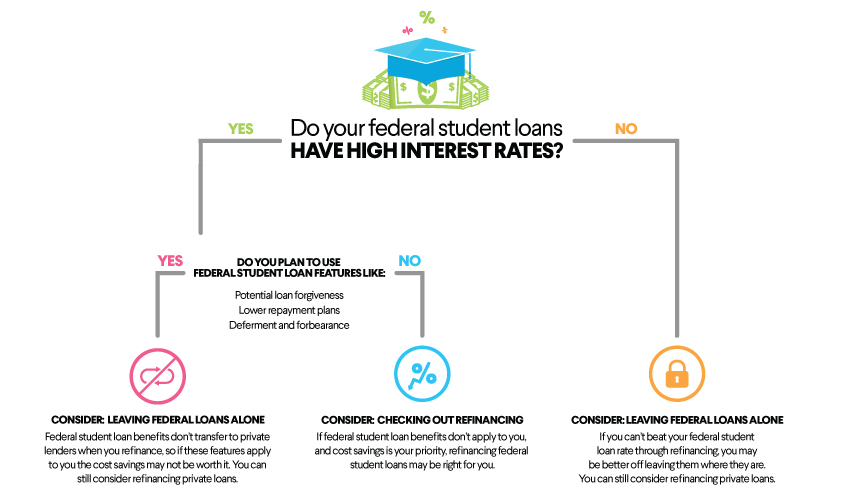

If you’re still debating what to do, here’s an easy decision tree to help you understand whether refinancing federal and private loans is the right option for you:

Steps to Consolidating Private and Federal Loans

If you decide that loan consolidation makes sense, here’s how to consolidate private and federal student loans through refinancing:

1. Decide which loans you want to consolidate. For instance, maybe you’d like to combine some of your federal loans with your private loans, but not all of them.

2. Look into lenders. Private lenders that provide refinancing include banks, credit unions, and online lenders. Each one offers different rates and terms. Find out about any fees they might charge, what kind of customer service they have, and what their eligibility requirements are.

3. Shop around. Each lender uses different criteria to determine if you’re eligible for a loan and the rates and terms you may get. To help find the best deal, you can prequalify with several lenders. Prequalifying involves a soft credit check, not a hard credit inquiry, so your credit score won’t be affected.

4. Apply for refinancing. Once you’ve selected a lender, you can fill out a loan application. You can typically do this online. You’ll need to provide your personal, employment, and salary information, as well as details about your private and federal student loans. Be sure to have backup like pay stubs and loan paperwork readily available since you may need to provide it. The lender will do a hard credit check, which could temporarily cause your credit score to drop a few points.

5. Find out if you’re approved. In general, you’ll learn whether you’re approved within several days. Keep an eye out for information from your new lender about the payments and due dates on the new loan.

Federal Student Loan Interest Rates

Depending on loan type and disbursement date, federal student loan interest rates are reassessed annually, every July. For the 2025-2026 school year, interest rates on new federal student loans range from 6.39% to 8.94%. Interest rates on federal student loans are determined by Congress and fixed for the life of the loan.

How Interest Rates Affect Consolidation and Refinancing Decisions

As noted earlier, when you apply to refinance, private lenders evaluate things like your credit history and credit score, as well as other personal financial factors, to determine the interest rate and terms you may qualify for.

If you’ve been able to build credit during your time as a student, or your income has significantly improved, you may be able to qualify for a more competitive interest rate than the rate on your current federal student loans — and perhaps any private student loans you have — when you consolidate your loans by refinancing with a private lender.

To get an idea of how much refinancing could potentially reduce the cost of interest on your loans, crunch the numbers with SoFi’s student loan refinancing calculator.

Federal Student Loan Benefits

Federal student loans come with a number of federal benefits and protections. If you refinance your federal loans — whether you’re consolidating them with private loans or not — the loans will no longer be eligible for federal benefits and protections.

Protections You May Lose When Combining Loans

Before you move ahead with refinancing, take a look at your loans to see if any of the following federal loan benefits and programs apply to you — and whether you might want to take advantage of them in the future. If you think you might need any of these protections, combining loans by refinancing them likely isn’t a good idea for you.

Student Loan Forgiveness

There are a few forgiveness programs available for borrowers with federal student loans. For example, under the Public Service Loan Forgiveness Program (PSLF), your Direct Loan balance may be eligible for forgiveness after 120 qualifying, on-time payments if you’ve worked in public service for an eligible nonprofit or government organization that entire time.

Pursuing PSLF can require close attention to detail to ensure your loan payments and employer qualify for the program. The qualification requirements are clearly stated on the PSLF section of the Federal Student Aid website.

Similarly, the Teacher Loan Forgiveness Program is available for teachers who work in eligible schools that serve low-income families full-time for five consecutive years. The total amount forgiven depends on factors like the eligible borrower’s role and the subject they teach.

Income-Driven Repayment Plans

Income-driven repayment plans can ease the burden for eligible borrowers who feel their loan payments are higher than they can afford. With income-driven repayment, monthly payments are calculated based on borrowers’ discretionary income and family size, which can lower how much you owe each month. That can make your student debt more manageable. The repayment period on these plans is 20 to 25 years.

Just be aware that when you lower your payments or extend your repayment term, you’ll pay more interest over time.

Deferment or Forbearance

Borrowers who are having difficulty making payments on their student loans may qualify for deferment or forbearance, two programs that allow borrowers to temporarily pause payments on their federal student loans.

The biggest difference between them is that with forbearance, the borrower is responsible for paying the interest that accrues on the loan. Forbearance can have a major financial impact on a borrower, as any unpaid interest will be added to the original loan balance. With deferment, the borrower may or may not be responsible for paying the interest that accrues. For instance, those with Direct Subsidized Loans are not responsible for paying the accruing interest.

Refinancing Your Student Loans

Looking to lower your monthly student loan payment? Refinancing may be one way to do it — by extending your loan term, getting a lower interest rate than what you currently have, or both. (Please note that refinancing federal loans makes them ineligible for federal forgiveness and protections. Also, lengthening your loan term may mean paying more in interest over the life of the loan.) SoFi student loan refinancing offers flexible terms that fit your budget.

FAQ

How does refinancing affect my credit score?

Refinancing affects your credit score because when you submit a formal loan application, the lender will check your credit score and credit history, which is known as a hard credit inquiry. That may cause your credit score to drop a few points temporarily.

Can I keep federal loan protections if I refinance?

No. Refinancing federal student loans with a private lender means that you lose access to federal programs and protections like income-driven repayment and forgiveness.

What are the risks of refinancing student loans?

The risks of refinancing federal student loans is losing access to federal programs and protections. In addition, if you extend the term of the loan through refinancing to lower your monthly payments, you’ll end up paying more interest over the life of the loan.

Is it better to consolidate or refinance student loans?

Whether it’s better to consolidate or refinance your student loans depends on your situation. If you have federal loans and want to combine them all into one loan to streamline your payments and make them more manageable, consolidation may be the right option for you.

On the other hand, if you have private loans and your credit and financial background is strong, refinancing may help you get a lower interest rate, which could help you save money. Refinancing may also be worth considering if you have federal loans and won’t need to use any of the federal benefits they provide, and you can qualify for a lower interest rate.

What should I consider before combining federal and private student loans?

Before combining federal and private student loans through refinancing, make sure you won’t need to use any of the federal benefits that federal student loans provide, such as income-driven repayment and deferment. Remember, refinancing makes federal loans ineligible for these programs.

Also, consider whether your credit and financial history is strong enough to qualify for a lower interest rate than you have on your current loans before refinancing.

SoFi Student Loan Refinance

Terms and conditions apply. SOFI RESERVES THE RIGHT TO MODIFY OR DISCONTINUE PRODUCTS AND BENEFITS AT ANY TIME WITHOUT NOTICE. SoFi Private Student loans are subject to program terms and restrictions, such as completion of a loan application and self-certification form, verification of application information, the student's at least half-time enrollment in a degree program at a SoFi-participating school, and, if applicable, a co-signer. In addition, borrowers must be U.S. citizens or other eligible status, be residing in the U.S., Puerto Rico, U.S. Virgin Islands, or American Samoa, and must meet SoFi’s underwriting requirements, including verification of sufficient income to support your ability to repay. Minimum loan amount is $1,000. See SoFi.com/eligibility for more information. Lowest rates reserved for the most creditworthy borrowers. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change. This information is current as of 4/22/2025 and is subject to change. SoFi Private Student loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi Private Student Loans

Please borrow responsibly. SoFi Private Student loans are not a substitute for federal loans, grants, and work-study programs. We encourage you to evaluate all your federal student aid options before you consider any private loans, including ours. Read our FAQs.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOSLR-Q225-033

Read more