Ways to Build Wealth at Any Age

There are many time-honored ways to build wealth — at any age — and most of these methods include a few important steps: learning to set goals, save and invest, and avoid high-interest debt.

In other words, it’s possible to build wealth at any age, because almost anyone can learn the fundamental tenets of wealth-building. Embracing smart money-management habits may improve your long-term financial security, whether you use those funds for the purchase of a home, long-term goals such as retirement, or estate planning for after you’re gone.

The key, however, is to start as soon as possible, rather than wait until the right time (which may never come).

Key Points

• Building wealth can be accomplished at almost any age, because it’s the result of mastering smart money management skills.

• The common elements of wealth building include learning skills like saving, investing, setting goals, and avoiding certain types of debt.

• Wealth building also requires learning how to put your money into assets that have the potential to gain value.

• Being proactive about wealth building means saving and investing for the future, while finding ways to enjoy the present, too.

• Understanding wealth building at different ages also requires understanding specific challenges that can arise at various times of life.

Set Short- and Long-Term Goals

The first step in building wealth is to set short- and long-term goals that you can revisit and revise at any time, as needed.

Short-term goals focus on achieving near-term results, such as funding next summer’s trip or buying a new car.

In contrast, long-term goals might require several years or more of preparation. For example, you may want to collect enough to pay off your mortgage or send your kid to college . Creating realistic goals gives you direction, so make them as specific as possible.

Create a Budget

Once you know your goals, drafting a monthly budget is the next step.

Document up to three months’ worth of expenses by using a spending-tracker app, or a basic notebook. Then, break the list down into fixed costs, variable costs, necessary costs, and discretionary costs. It’s essential to know where your money is going, in order to make smart decisions about your priorities.

You probably can’t stop paying your utilities, but you will likely find places to save in your discretionary category (think restaurant meals, or entertainment expenses). Making cuts in some areas can help you channel money into your goals.

There are a number of effective budgeting methods and systems. Some rely on an app, others use hands-on strategies such as dividing your spending into separate envelopes. It’s important to try different budgets and find one you can stick with.

Pay Off Debt

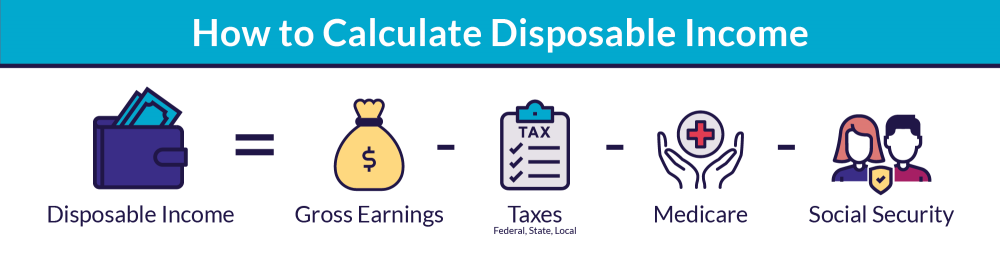

To dedicate more money toward building wealth and saving for your goals, you’ll likely need to pay off some debt first. You can use your discretionary income as a tool for minimizing your debt load.

If you have multiple debts, consider using a debt reduction method, such as the avalanche method or the snowball method, to accelerate the process.

The Avalanche Method

The avalanche method prioritizes high-interest debts by ranking the interest rates from highest to lowest. Then, regularly pay the minimum on each of your debts, and put any leftover funds towards the one with the highest interest rate.

Once you pay that off, continue on to the second-highest debt. Follow that pattern to minimize the interest you’re paying as you become debt-free.

Snowball Method

Alternatively, the snowball method is another debt repayment strategy. It’s essentially the opposite of the avalanche approach. List your debts from the smallest balance to largest, ignoring the interest rates. Then, regularly dedicate enough funds to each to avoid penalties, and put any extra money toward the smallest debt.

After the smallest debt is paid, redirect your attention to the next largest debt, and so on. As the number of individual debts shrink, you’ll have more money to apply towards the larger debts. You may still have interests to worry about but picking off the debts one by one can impart a sense of forward movement and accomplishment.

Start Investing

Investing is an important way to build wealth at any age. Generally speaking, there are two ways to invest when building wealth. The first step is to max out your retirement savings. The second is to invest on your own.

Investing for Retirement

If you haven’t already, find out what if any employer-sponsored retirement savings plans are available to you, such as a 401(k) plan. These qualified retirement plans offer tax advantages, and typically allow you to direct a portion of your paycheck to your account, thus putting your savings on autopilot.

If your workplace does not offer any retirement accounts, consider whether you want to open an IRA — or a brokerage account to build an investment portfolio.

Generally, investing for retirement when you’re young means you can take on more risks. While a diversified portfolio is a standard strategy, younger investors might have a portfolio that’s heavier on equities , since they may help generate long-term growth.

As you get older and closer to retirement, your risk profile may change and your portfolio will need a rebalancing to incorporate more fixed-income investments, such as bonds, which are considered lower risk than stocks. Understanding stock market basics can help you become a more savvy investor.

Investing on Your Own

While investing for retirement should be a key part of your long-term wealth-building strategy, it’s also possible to open a taxable brokerage or online brokerage account for additional growth potential.

Investing always comes with the risk of loss, but many investors find ways to put their money to work by investing in low-cost mutual funds or exchange-traded funds (ETFs), as well as other types of securities.

One important aspect of active investing is knowing what the costs are. You may have to pay brokerage fees, expense ratios, trading commissions, and other charges. While these may seem small, or may be couched as a tiny percentage, investment fees can add up over time and reduce your returns.

How to Increase Your Income and Save More

You might be getting by on your current income, but there may be ways to boost what you bring home. With an extra-positive cash flow, you could pay down debt and save more, and achieve your goals sooner. Here are a few ways to make that happen.

Ask for a Raise

Asking for a salary increase is one solution for improving your cash flow. All it takes is a few good conversations, a positive work record — and a bit of courage and confidence. Speak to your peers and read up on how to conduct yourself when asking for a raise. Going in with a plan will save you anxiety and help you get your points across clearly.

Start a Side Gig

Additional work is also great to bulk up your resume and create new connections. It seems like everyone is starting up a side hustle these days. From online shops to freelancing, the opportunities are endless. All you have to do is determine your marketable skills and how to advertise them. There might be local opportunities, or you can create a profile online on side hustle-oriented websites.

Cut Expenses

Sometimes it’s not about finding new sources of money, but about creating a larger pool with the money already coming in. Take a second pass at your list of discretionary expenses to pinpoint a few more areas you could cut back on without feeling the impact in your day-to-day life.

One good example: Automatically renewed subscriptions for streaming services and local businesses, like gyms, are convenient. But think about how frequently you use the service. If the answer is “not often,” you’re not getting your money’s worth — and you may want to negotiate a lower fee, or cut the subscription altogether.

How to Build Wealth at Every Stage of Life

While it’s good to have a general strategy in place for building wealth and increasing cash flow, different stages in your life may require you to focus on different things. Taking advantage of the opportunities each decade brings you will help you financially adjust and build a stable lifestyle.

In Your 20s

You may be right out of school and trying to navigate the job market, but don’t wait to start working towards your long-term financial goals. The sooner you start, the sooner you’re likely to reach your goals.

Create an Emergency Fund

Generally, an emergency fund should include about three to six months’ worth of living expenses. Although that sounds like a lot, start small and save what you can. You’ll be grateful for the cushion if you should lose your job, need a car repair, or have a medical emergency.

Unexpected things happen all the time, and an emergency fund will protect you while you get things back up and running. It will also keep you from having to tap your savings accounts.

Eliminate High-Interest Debt

Your student loans aren’t going anywhere, so pay off student debt as soon as possible. The same goes for any other high-interest debt you might have incurred, such as with a credit card. Paying high interest rates will limit your ability to save.

However, don’t be afraid to use your credit cards responsibly. Your 20s are the perfect time to build good credit, which will be vital to certain goals, like purchasing a house. Use them strategically and pay them off immediately to build an upstanding credit history.

In Your 30s

Your 30s may bring some stability into your life, whether it’s a steady career, a partner, and/or kids. However, the costs you’re facing are likely growing with you. Focus on money moves that will benefit you long-term.

Plan for College Expenses

If you have children, saving for their education is a big step. Use opportunities like a 529 account to help provide the funding. A 529 plan is a tax-advantaged savings plan you can use to pay for future tuition and related costs. While saving for college is important, it’s essential to balance this with funding your retirement — which is an even bigger priority.

Pad the Nest Egg

By some popular estimates, by age 30 you should have at least one year’s worth of your annual salary saved for your retirement — and twice that by 35. Incrementally increasing the amount you put towards your savings will help boost that number as well. While these targets may seem big, the more important thing is to save steadily over time — that’s how real wealth-building happens.

In Your 40s, 50s and Beyond

By 40, conventional wisdom holds that you should be well on your way to a growing nest egg with three times your annual salary saved up. Again, this is just a target — but it can help you stay on track.

At this stage, you may also have other assets to your name, such as a home. If you have kids, they might be nearing college age, and retirement might not seem quite as far away as it once did. This will motivate you to save for your goals.

Protect Your Self and Your Wealth

It’s always smart to protect your assets — and yourself. Make sure you have insurance covering both you and your estate (through health and life insurance). Insurance can take a burden off of your family’s shoulders in case anything happens to you.

Capitalize on Make-Up Contributions

Maximizing your retirement savings is a key part of wealth-building at every age.

A make-up, or catch-up, contribution, is an additional payment that anyone over age 50 can make to their 401(k) or IRA account. If you’re in a financial position to contribute these extra funds, it can help bulk up those savings to help prepare for retirement.

For 2025, you can contribute up to $23,500 per year, and if you’re 50 or older, the maximum allowable catch-up contribution to 401(k) plans per year is $7,500, for a total of $31,000. In 2026, you can contribute up to $24,500 per year, and if you’re 50 or older, you can make a catch-up contribution of up to $8,000, for a total of $32,500.

However, there’s also something called a super catch-up contribution, which allows employees aged 60 to 63 to contribute an extra $11,250 in both 2025 and 2026 (instead of $7,500 and $8,000).

Under a new law that went into effect on January 1, 2026 as part of SECURE 2.0, individuals aged 50 and older who earned more than $150,000 in FICA wages in 2025 are required to put their 401(k) catch-up contributions into a Roth 401(k) account, meaning they’ll pay taxes on catch-up contributions upfront, but can make qualified withdrawals tax-free in retirement.

The annual IRA contribution limit for 2025 is $7,000, with those 50 and above allowed to contribute another $1,000 per year. In 2026, the limit if $7,500, with those 50 and older allowed to contribute an extra $1,100 per year. In total, anyone 50 or older can put $8,000 into their traditional or Roth IRA annually in 2025, and $8,600 in their IRA annually in 2026.

There are other types of retirement accounts for self-employed people that allow you to save more than in ordinary IRAs. Choosing the type of plan that matches your needs and helps you save and invest more is key to building wealth long term.

Wait to Take Social Security

Did you know you could receive a higher Social Security benefit if you wait to claim your benefits? Those who hold off collecting Social Security until age 67 — the full retirement age for people born in 1960 or afterward — get 108% of their benefits, and those who wait until the age of 70 can receive 132% of their monthly benefit.

On the other hand, if you begin taking benefits early, at age 62, you’ll receive 25% less in monthly benefits.

Shift Your Asset Allocation

Investors should periodically revisit their portfolio and reassess their investments and risk level. As you get closer to retirement, you may decide to allocate a larger part of your portfolio to safer choices like bonds and other fixed-income assets. This may not increase your nest egg, but it can help prevent losses.

The Takeaway

Building wealth at any age starts with a close look at your current income and expenditures, a detailed list of short-term and long-range goals — and a little follow-through based on where you are in life.

Some ways to start building wealth are to take on a side gig or side hustle, find ways to cut expenses and increase savings rates, and to start investing. There are numerous ways to do any of these, and it may take some experimenting to see what works for you.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

FAQ

What are the key principles for building wealth?

The basic tenets of building wealth may seem simple, but they require discipline. Spending less than you make, setting goals and saving toward those goals, learning to invest, and avoiding high-interest debt are generally good places to start.

Is 40 too late to start building wealth?

Even if you start at age 40, you should have enough runway to build wealth that can help support you later in life.

Does investing build wealth?

Investing involves risk, and there are no guarantees that investing your money will help it grow. That said, learning the ropes of how to invest and manage your money may help build wealth over time.

About the author

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Mutual Funds (MFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or clicking the prospectus link on the fund's respective page at sofi.com. You may also contact customer service at: 1.855.456.7634. Please read the prospectus carefully prior to investing.Mutual Funds must be bought and sold at NAV (Net Asset Value); unless otherwise noted in the prospectus, trades are only done once per day after the markets close. Investment returns are subject to risk, include the risk of loss. Shares may be worth more or less their original value when redeemed. The diversification of a mutual fund will not protect against loss. A mutual fund may not achieve its stated investment objective. Rebalancing and other activities within the fund may be subject to tax consequences.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOIN-Q225-056

Q126-3525874-027