Budgeting as a New Doctor

Dr. Christine M. has always been goal-oriented about her finances. That approach worked well when she decided to become a doctor. She stretched an annual salary of $55,000 during her five years as a resident and fellow. Once she became a new doctor in private practice on the East Coast, she made paying down her medical school loans her top priority. By being frugal, she was able to pay them off in three years.

The road to becoming a doctor is long — 11 years at a minimum — and the average cost of medical school is expensive. The median medical school debt for borrowers in the Class of 2024 is $205,000, according to the Association of American Medical Colleges. And that’s not counting undergraduate student loans, credit card balances, or other debt.

But the hard work can pay off. The median annual salary for physicians and surgeons is $239,200. That’s a significant increase from the $65,100 median annual salary a first-year resident earns.

If you’re a doctor, the beginning of your career marks a new phase of your earning power. It’s also a prime opportunity to get yourself on sound financial footing, including paying off your medical school loans. That’s why budgeting is so important for doctors. These strategies can help you reach your financial goals.

Key Points

• New doctors should aim to save 30% of their income, with 25% for retirement and 5% for an emergency fund.

• Automating finances can help build good saving habits and ensure timely bill payments.

• New doctors can explore various investment vehicles for retirement savings, including HSAs and IRAs.

• Physicians may consider disability insurance to protect income in case of injury or illness.

• Develop a repayment strategy for medical student loans, such as income-driven repayment, using the avalanche or snowball method, or exploring medical loan refinancing.

Resist the Urge to Start Spending Right Away

After years of hard work and sacrifice, you may be tempted to treat yourself. But don’t go wild. “I think lifestyle creep is the biggest danger we see [among new doctors],” says Brian Walsh, CFP® and Head of Advice & Planning at SoFi. Leveling up early in your career can wreak havoc on your savings and financial health while setting unsustainable spending habits that are hard to break.

Automate your finances whenever possible. For instance, preschedule your bill payments and set up automatic contributions to your retirement account.

To encourage good spending habits, use cash or a debit card for purchases, Walsh suggests. You may also need to practice extra self-control. Because Christine was thrifty, she was able to triple her loan payments to $4,500 a month. She also made additional payments whenever she could. “You just have to keep reminding yourself what your priorities are because it’s easy to want more,” she says.

Get Serious About Savings

As a new doctor, you may not start your career until you’re in your thirties, which puts you behind the curve on saving for long-term goals. The good news: earning a higher income can help you make up for lost time.

Walsh advises early-career physicians to set aside 30% of their income for savings. Of that, 25% should be for retirement and 5% for other savings, like starting an emergency fund that can tide you over for three to six months. The remaining 70% of your income should go toward expenses, including monthly medical school loan payments.

The sooner you start saving and investing, the sooner you can enjoy compound growth, which is when your money grows faster over time. That’s because the interest you earn on what you save or invest increases your principal, which earns you even more interest.

Consider Different Investments

For investing your retirement savings, you may need to think beyond maxing out your 401(k) or 403(b), though you should do that as well. Walsh suggests new doctors tap into a combination of different investment vehicles. This strategy, known as diversification, may help protect you from risk. Here are some vehicles to consider:

• A health savings account (HSA), which provides a triple tax benefit. Contributions reduce taxable income, earnings are tax-free, and money used for medical expenses is also tax-free.

• An individual retirement account (IRA), like a traditional IRA or Roth IRA, can offer tax advantages. Contributions made to a traditional IRA are tax-deductible, and no taxes are due until you withdraw the money. Contributions to a Roth IRA are made with after-tax dollars; your money grows tax-free and you don’t pay taxes when you withdraw the funds. However, there are limits on how much you can contribute each year and on your income.

• After-tax brokerage accounts, which offer no tax benefits but give you the flexibility to withdraw money at any time without being taxed or penalized.

Two options to consider bypassing are variable annuities and whole life insurance. Walsh says they aren’t suitable ways to build wealth.

Regardless of the strategy you choose, keep in mind that there may be fees associated with investing in certain funds, which Walsh points out can add up over time.

Protect Your Income

There are a variety of insurance policies available to physicians, and disability insurance is one worth considering. It covers a percentage of your income should you become unable to work due to an injury or illness. If you didn’t purchase a policy during your residency or fellowship, you can buy one as part of a group plan or as an individual. Check to see if it’s a perk offered by your employer. Christine’s practice, for example, includes a disability plan as part of its benefits package. Monthly premium amounts vary, but in general, the younger and healthier you are, the cheaper the policy.

Recommended: Short Term vs. Long Term Disability Insurance

Develop a Plan to Repay Student Loans

No matter how much you owe, having the right repayment strategy can help keep your monthly payments manageable and your financial health protected.

To start, consider the types of student loans you have. Federal loans have safety nets you can explore, like loan forgiveness and income-driven repayment (IDR) plans, which can lower monthly payments for eligible borrowers based on their income and household size.

Once you’ve assessed the programs and plans you’re eligible for, determine your goals for your loans. Do you need to keep monthly payments low, even if that means paying more in interest over time? Or are you able to make higher monthly payments now so that you pay less in the long run?

Two approaches to paying down debt are called the avalanche and the snowball. With the avalanche approach, you prioritize debt repayment based on interest rate, from highest to lowest. With the snowball method approach, you pay off the smallest balance first and then work your way up to the highest balance.

While both have their benefits, Walsh often sees greater success with the snowball approach. “Most people should start with paying off the smallest balance first because then they’ll see progress, and progress leads to persistence,” he says. But, as he points out, the right approach is the one you’ll stick with.

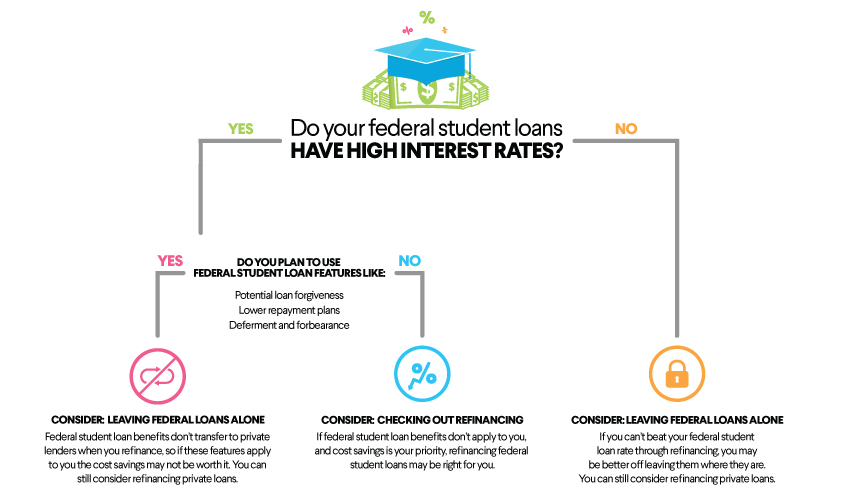

Explore Your Refinancing Options

Besides freeing up funds each month, paying down debt has long-term benefits, like boosting your credit score and lowering your debt-to-income ratio. And you may want to include refinancing in your student loan repayment strategy.

When you refinance, a private lender pays off your existing loans and issues you a new loan. This could give you a chance to lock in a lower interest rate than you’re currently paying and combine all of your loans into a single monthly bill. Some lenders like SoFi also provide medical professional refinancing.

Though the refinancing process is fairly straightforward, some common misconceptions persist, Walsh says. “People overestimate the amount of work it takes to refinance and underestimate the benefits,” he says. A quarter of a percentage point difference in an interest rate may seem inconsequential, for instance, but if you have a big loan balance, it could save you thousands of dollars.

That said, refinancing your student loans is not right for everyone. If you refinance federal student loans, for instance, you may lose access to benefits and protections, such as federal repayment and forgiveness plans. Weigh all the options and decide what makes sense for you and your financial goals.

The Takeaway

As a new doctor, you stand to earn a six-figure salary once you complete medical school and residency. But you’re likely also saddled with a six-figure student loan debt. Learning new strategies for saving and investing your money, and coming up with a smart plan to pay back your student loans, can help you dig out of debt and save for your future.

If you decide that student loan refinancing might be right for you, SoFi can help. Our medical professional refinancing offers competitive rates for doctors.

Photo credit: iStock/Ivan Pantic

FAQ

How do I budget as a new doctor?

To budget as a new doctor, start saving right away and resist the urge to overspend. Set aside 30% of your income for savings — of that, 25% should go to retirement savings and 5% to other savings, like an emergency fund. Use the remaining 70% of your income to pay for expenses and bills.

In addition, automate your finances. Set up auto-pay for bills and automatic contributions to your retirement accounts, including 401(ks) and IRAs. Finally, develop a plan to repay your student loans. Explore different repayment plans to see which one is best for you.

How much debt does a new doctor have?

The median medical school debt for borrowers in the Class of 2024 is $205,000, according to the Association of American Medical Colleges. That’s not counting undergraduate student loans.

How much does a doctor make?

The median annual salary for physicians and surgeons is $239,200. That’s much more than the $65,100 median annual salary a first-year medical resident earns.

SoFi Student Loan Refinance SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOSLR-Q225-047

Read more