Guide to Biotech Investing: All About Biotech Stocks

Biotech investing can be an exciting world or established players and many startups. Here’s a look at what you need to know before investing.

Read moreBiotech investing can be an exciting world or established players and many startups. Here’s a look at what you need to know before investing.

Read morePlanning to retire at 62 is worth considering, but whether it’s a realistic goal depends on how much you’ve saved, your anticipated living expenses, and an educated estimate of your likely longevity.

If you choose to retire at 62, which is on the early side these days, it’s important to have a solid retirement strategy in place so that you don’t run out of money.

Your answer will depend on your overall financial situation and how much preparation you’ve put into planning for early retirement. Retiring at 62 could make sense if:

• You have little to no debt

• Your overall living expenses are low

• You’ll have multiple streams of income to draw on for retirement (e.g. Social Security as well as an IRA, 401(k), or pension)

• Don’t anticipate any situations that could hinder your ability to meet your retirement expenses (e.g. medical expenses, dependent family members)

On the other hand, retiring at 62 could backfire if you have limited savings, extensive debt, or you think you might need long-term care later in life, which could substantially drain your nest egg.

Beyond financial considerations, it’s also important to think about how you’ll spend your time in retirement.

You might retire at 62 and find yourself with too much time on your hands, which could lead to boredom or dissatisfaction. While studies have shown that retirement, and in particular early retirement, can improve mental health for some individuals, it may worsen mental health for others.

💡 Recommended: Retirement Planning Guide for Beginners

There is no single dollar amount that’s recommended for retirees, though financial experts might say that $1 million to $2 million is an optimal goal to aim for. If you haven’t saved close to those amounts, you might be wondering how to retire at 62 with little money.

Defining for you can help you decide if retiring at 62 is realistic. Asking these questions can help you clarify your retirement vision:

• Will you continue to work in some capacity?

• How much do you have saved and invested for retirement?

• Will you take Social Security benefits right away or wait?

• What does your monthly retirement budget look like?

• What kind of lifestyle are you hoping to enjoy?

• How much do you anticipate paying in taxes?

Retiring at 62 with little money could be workable if you plan to relocate to an area with a lower cost-of-living, and cut your expenses. It also helps if you have additional money from Social Security, a pension, or an annuity that you can count on.

The longer you have until retirement, the more time you have to invest and grow your money through the power of compounding interest. If you’re planning to retire at 62, adjusting your strategy to be aggressive might be necessary since you:

• Have less time save

• Need the money that you do save to last longer

Instead of saving 15% of your income for retirement, for instance, you might need to set aside 30% or more to cover your living expenses. And rather than stick with a conservative asset allocation, you may want to lean toward a higher percentage of equities to add growth.

For example, if you plan to stop working completely, you’ll need to weigh the cost of health care until you become eligible for Medicare. You can’t apply for Medicare until the year you turn 65. If you have a health condition that requires regular care, you may need to increase your savings cushion to cover those expenses until you become eligible.

It’s also important to think about where to keep the money you’re investing for retirement at 62. There are different retirement plans that you can use to invest, starting with a 401(k).

A 401(k) plan is generally a workplace plan that allows for tax-advantaged investing. Contributions are deducted from your taxable income and grow tax-deferred. Once you retire, withdrawals are taxed at your ordinary income tax rate.

You can begin making withdrawals penalty-free at age 59 ½, or potentially earlier if you meet Rule of 55 guidelines. This IRS rule enables you to avoid early withdrawal penalties if you leave your job and withdraw from your 401(k) the year you turn 55.

A 457 plan is another option for saving in the workplace. These plans are offered by state and local governments as well as certain non-profits, and they work similarly to 401(k) plans. Whether you have a 401(k) or 457 retirement account, investing consistently matters if you’re planning to retire at age 62.

The good news is that you can fund a 401(k) or 457 plan automatically through salary deferrals. You can adjust the amount you save each year as you get raises to help you get closer to your goals. And if your employer matches contributions, that’s free money you can use to plan for early retirement.

1Terms and conditions apply. Roll over a minimum of $20K to receive the 1% match offer. Matches on contributions are made up to the annual limits.

The chief benefit of investing for retirement at 62 is that you can grow your money faster than you would by saving it.

When you put your money into the market, you can potentially earn higher returns than you would by keeping it in a savings account or a certificate of deposit (CD). The trade-off, of course, is that you’re also taking more risk by investing versus saving.

It’s important to choose a retirement plan that fits your investment goals. With a workplace plan, you’re typically offered a range of mutual funds and exchange-traded funds (ETFs). The investments you choose should reflect both your risk tolerance and your risk capacity, meaning how much risk you need to take to reach your financial goals. Take too much risk and you could lose money; take too little risk and your money won’t grow enough to fund an early retirement.

It’s also important to consider the fees you’re paying for those investments. Mutual funds and ETFs have expense ratios, which determine how much it will cost you to own them on a yearly basis. The higher the fees, the more they can eat into your returns.

So, can you retire at 62? It can be a difficult question to answer if you’re not considering all the factors that affect your decision. If you have early retirement in your sights, then there are several things to weigh.

Medicare eligibility doesn’t begin until the year you turn 65. So, you’ll need to consider how you’ll pay for medical care in the interim. You could purchase private insurance or continue COBRA coverage through your former employer, but either option could be expensive.

Long-term care is another consideration. The monthly median cost of long-term care ranges from $1,690 for adult day care to $9,034 for a private room in a nursing facility, according to Genworth. Long-term care insurance can help with some of those costs but if you don’t have this kind of coverage, and you or your spouse requires this type of care, it could eat into your savings.

Some household expenses in retirement could be lower. For example, if you move to a smaller home, you might have a lower mortgage payment. Utility bills may also decrease with a smaller home. Or you might have no mortgage payment at all if you’re able to pay off your home loan when you retire.

On the other hand, your household expenses could increase if you move to a more expensive area. Buying a retirement home in southern Florida, for example, could easily be more expensive compared to living in the Midwest. And your expenses could also climb if your adult child or grandchild unexpectedly moves in with you.

Retirement generally means that your regular paychecks go away. Instead, you live on savings, investments, Social Security, pensions, or some combination of those things.

If you want to retire at 62, you’ll have to think about how much of an impact a lack of steady income might have financially. You may not miss those regular paychecks if you’re able to draw enough from savings, investments, and other income sources in retirement.

But if you’re in a pinch, you may need to consider ways to make up for a shortfall, such as getting a part-time job or starting a business or side hustle.

It’s also important to consider your savings withdrawal rate. This is the rate at which you draw down your savings and investments monthly and annually to fund your retirement lifestyle. The 4% rule is an often-used rule of thumb for determining retirement withdrawals.

For example, say that you’ve saved $500,000 for retirement by age 62. Following the 4% rule, you can withdraw 4% of your savings to live on each year. If you stick to that rule and your portfolio continues to generate a 3% annual rate of return, then $500,000 would be enough to last you until age 97.

That assumes a 3% inflation rate. If inflation is higher at 8%, your money would run out by age 82. So, inflation is another important consideration to factor in when deciding if you can retire at 62.

Determining a day to retire matters if you’re planning to take Social Security benefits at 62. If you’ll be relying heavily on those benefits for income, it’s important to apply in a timely manner so they kick in when needed — but you get the maximum amount possible under the circumstances.

When deciding when to retire, remember that taking Social Security at 62, or any other time before your full retirement age, will reduce your benefit amount. Working part-time can also reduce your benefits if you’re earning income above certain thresholds. Meanwhile, you could increase your benefit amount by delaying benefits up to age 70. Think about how important Social Security is for completing your retirement income picture and when you’ll need to take it.

Whether you’re planning to retire at 62 (or any age), having a plan can work in your favor. Estimating your expenses, setting a target savings goal, and investing in your workplace retirement plan can all help you to get on the right track.

You can open a retirement account online and start building a diversified portfolio. And if you’re assessing your retirement savings, you may want to roll over your old 401(k) accounts to an IRA, so you can manage your money in one place.

SoFi makes the rollover process seamless. You don’t have to watch the mail for your 401(k) check because the transfer is handled automatically, and there are no rollover fees.

Help grow your nest egg with a SoFi IRA.

Retiring at 62 could be a good idea if you can afford it and you’ve planned for any what-if scenarios that could affect your ability to cover your expenses. If you have significant amounts of debt and minimal savings, however, retiring at 62 may do more harm than good.

Retiring at 62 with little money requires careful planning to understand what your expenses will be, how much money you’ve saved, and how long that money will last. Supplementing savings with Social Security benefits or a pension can help, though you may need to plan to live much leaner in order to stretch your dollars.

The longer you wait to retire, the more time you have to invest and build wealth. Delaying retirement after 62 can also increase the amount of benefits you’re eligible to receive from Social Security.

Photo credit: iStock/kate_sept2004

SoFi Invest® INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOIN0722012

A trade school, often called a vocational or technical school, provides specific job skills to start a career quickly in a given trade, with the requisite certifications and licenses. That career can range from being an electrician to a physician’s assistant to a cook. As opposed to a four-year college, a trade school education is generally completed in just two years and focuses on getting students hands-on experience and securing the job they want.

Trade school costs can vary anywhere from around $3,000 to $15,000+ per year. While trade school can be significantly less costly, and require less time, than a four year degree — there are still expenses to consider. Continue reading for more information on how expensive trade school is and planning for trade school costs.

Table of Contents

Key Points

• Trade schools offer focused training in specific job skills, allowing students to enter careers quickly, typically completing programs in less than two years.

• The annual cost of trade school tuition can range from approximately $3,600 to $14,500, depending on factors like the school and program.

• Additional expenses for trade school often include costs for books, supplies, and living expenses, which can vary greatly based on individual circumstances.

• Financial options for attending trade school include federal aid, grants, scholarships, and part-time work, which can help cover educational costs.

• When selecting a trade school, important considerations include program accreditation, completion time, available on-the-job training opportunities, and employment support services.

College is not for everyone. Trade school can provide a path to a rewarding career, without the time and money required to pursue a four-year degree.

As previously mentioned, trade school is a type of education that provides training in a specific job or skill set to allow students to start a given trade or career with the requisite certifications and appropriate licenses. Also known as vocational or technical schools, trade school can be a stepping stone into a career as a plumber, electrician, plumbing, dental hygienist, pharmacy technician, paralegal, and more.

Trade schools may be private or public institutions. And it can take as little as a few months to two plus years to complete a trade school program. Community colleges may offer vocational programs or more general education classes for students planning to transfer to a four-year institution.

The cost of trade school can vary widely based on factors including the school, the program you are pursuing, your location. According to TradeSchools.net, the average cost of annual tuition at a trade school can range from $3,600 to $14,500.

As mentioned, the cost of tuition can range dramatically, averaging anywhere from $3,600 to $14,500 per year. According to data from the U.S. Department of Education’s College Affordability and Transparency List, for the 2020-2021 school year, the average cost of tuition and fees at two year institutions was:

• 2-year, public — $3,863

• 2-year, private not-for-profit — $15,549

• 2-year, private for-profit — $15,033

• Less than 2-year, public — $8,683

• Less than 2-year, private not-for-profit — $13,127

• Less than 2-year, private for-profit — $13,127

Again, the cost of books and supplies will vary based on the vocational program or trade school. According to data from The College Board, the average cost of books at a two-year public institution was $1,460 for the 2021-2022 school year.

Unsurprisingly, the cost of living expenses can also vary quite dramatically from student to student. Some students who are attending trades school may be able to live at home with family members. This could help them reduce costs because they may be able to have little to no rent, and share meals with family members.

Trade school students who are living on their own may need to budget for more expensive living costs.

When it comes to paying for college, or trade school, there are a few options available to students including loans, federal aid, grants, and more.

The term “trade school loan” is just a way to refer to a student loan, personal loan, or outside funding measure used to pay one’s way through a training or vocational school.

Many trade and vocational schools may qualify for federal student loans and other forms of federal financial aid. To apply for federal loans, students will need to fill out the Free Application for Federal Student Aid (FAFSA®) each year.

There are limits for federal student loans, and some students may consider a private student loan. Private student loans are available from private institutions but they may not offer the same benefits or protections as federal student loans.

After all other funding options have been exhausted, a private student loan could be a tool to help fill in the gaps. SoFi private student loans have zero fees and qualifying borrowers can secure competitive rates. While SoFi’s private student loans’ aren’t available to pay trade school, some graduate certification programs may qualify.

Trade schools generally offer flexible programming — for example, night classes — so students may be able to work part-time to fund their education. Students may consider getting a part-time job in the field they are studying, or working at a gig that is willing to accommodate their school schedule so they have enough time to take classes and study.

As already mentioned, trade schools may qualify for federal financial aid — including student loans, grants and scholarships. Federal aid can be used for technical schools and some certificate programs as long as the schools are accredited and eligible for federal funds. You can check the Department of Education’s database of qualifying schools to confirm your chosen trade school program qualifies.

Again, to apply for federal financial aid, students will need to fill out the FAFSA each year.

Students at eligible trade schools may qualify for a Pell Grant. A Pell Grant is a type of federal grant that is awarded to students who demonstrate exceptional financial need.

There may also be scholarships available for trade school students. Certain trade schools may offer scholarships and there are vocational school scholarships available from private organizations too. Check in with your school’s financial aid office for more information or look through an online database or SoFi’s scholarship search tool to peruse scholarships you may be eligible for.

Trade school can make a lot of sense for students who are interested in pursuing a specific vocation and are not interested in attending a more traditional four-year school. To evaluate trade schools, consider the following factors:

• Program Accreditation. This can give you an idea of a program’s reputation. Accredited schools may qualify for federal financial aid.

• Time to complete. This can inform the total cost of the program.

• Opportunities for paid on-the-job training. Some programs may offer a combination of in-classroom learning and paid job training. Gaining this real world experience can be valuable.

• Employment assistance or support. Some trade schools have close connections with local businesses or industries. Find out if there is a career connections office or any job placement assistance.

SoFi doesn’t offer student loans for trade school programs, but does offer student loans for eligible graduate certificate programs. If you’re a college student interested in pursuing a certificate program, a SoFi private loan could be a tool to help you finance the program.

SoFi student loans have zero fees and qualifying borrowers can secure competitive interest rates. Find out if you prequalify in just a few minutes.

Trade schools are generally more affordable than a college or university. In addition to having a more affordable annual tuition, typically trade school programs can be completed in less than four years.

According to Accredited Schools Online, some of the top-paid trades school jobs include construction managers, radiation therapists, and dental hygienists.

The length of trade school can vary based on the program. Some trades school programs can be completed in a few months while others may take two years to complete.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Private Student Loans

Please borrow responsibly. SoFi Private Student Loans are not a substitute for federal loans, grants, and work-study programs. You should exhaust all your federal student aid options before you consider any private loans, including ours. Read our FAQs.

SoFi Private Student Loans are subject to program terms and restrictions, and applicants must meet SoFi’s eligibility and underwriting requirements. See SoFi.com/eligibility-criteria for more information. To view payment examples, click here. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOPS0322005

Blockchain technology has grown way beyond its roots as the foundation of most cryptocurrencies into an expansive tech sector that investors may want to consider. For those wondering how to invest in blockchain, there are multiple opportunities, from trading crypto to investing in companies that are developing new uses for blockchain.

The transparent, digital ledger known as blockchain is associated primarily with different types of crypto, but it has a rapidly growing number of use cases across many sectors: health care, law, real estate, finance, international trade, and more.

For investors willing to do their due diligence, and understand the risks involved, there are opportunities in the blockchain space.

In order to understand what blockchain tech is, it helps to know the basics of how a blockchain works. While blockchain was the innovation in 2009 that made Bitcoin — and the entire cryptosphere — possible, numerous applications for blockchain technology have emerged since then.

Think of blockchain technology as a sort of next-level, digital infrastructure. It’s a transparent, append-only digital ledger that can be used to track or record almost any type of asset, from goods and services to patents, smart contracts, decentralized apps (dApps), and more.

Blockchain technology relies on cryptography and a system of peer-to-peer (P2P) verification to secure transactions and, in the case of cryptocurrency, to mine coins and tokens. Because the security of blockchain is critical to how it functions, complex consensus algorithms are used on each network.

Although most people think crypto goes hand-in-hand with blockchain, in fact blockchain technology is increasingly common for a range of digital products and functions. Anything that requires an immutable ledger, contract agreement, or data transaction record can use blockchain — such as real estate transactions, legal agreements, voting records, supply-chain tracking, and much, much more.

Can you invest in blockchain? While you cannot invest directly in a blockchain itself — a blockchain can’t be owned by investors — there are multiple ways to invest in blockchain technology, and a growing number of sectors that use it.

• By investing in crypto, you can think beyond the coin to what the entire crypto project is trying to create using its particular blockchain capabilities. The blockchain that supports the Ethereum network has different capabilities than the one that supports Bitcoin, Dogecoin, Litecoin, and so on.

• You can invest in blockchain stocks and other securities, like exchange-traded funds (more on that below), initial coin offerings (ICOs), and cryptocurrency trusts. While many of these investment products are new, and may come with risks, they may also present new opportunities.

Investing in blockchain technology is a way to participate in the evolution of a whole new part of the market, which includes DeFi (decentralized finance) companies, digital securities, crypto exchanges — as well as existing sectors like real estate and supply chain management that are increasingly embracing blockchain.

Because blockchain is a big part of how cryptocurrency works, buying crypto is one way to invest in blockchain. Investing in cryptocurrencies means buying individual tokens that can be used within the blockchain technology ecosystem. And because each coin or token is so different, reflecting the blockchain it’s based on, interested investors can explore different types of crypto as a way of investing in different blockchain capabilities.

For example, some blockchains are programmed to support the execution of smart contracts, the creation of non-fungible tokens (NFTs), the cross-border transfer of funds, and much more. By owning the crypto that’s part of that ecosystem, you’re essentially investing in that blockchain. But there are many other ways to invest in blockchain today.

Here are some of the other ways to invest in blockchain. Because this is an evolving space, it’s important to carefully weigh the potential risks, as well as the likely costs, of some of these investments:

While investing in crypto can give you access to blockchain as an investment, Wall Street has found a few ways to make crypto more accessible to institutional investors through the use of crypto exchange-traded funds (ETFs), crypto trusts, crypto index funds, and other securities.

Bear in mind that investing in funds that invest in crypto can be a risky proposition — and one that removes the investor another step from investing in actual blockchain technology.

And although these crypto investments may sound similar to traditional investments that can be bought and sold by main street investors, these funds are typically available only to institutional or accredited investors and they are traded on over-the-counter (OTC) markets. OTC markets are known to be less liquid and more risky.

There are some products available to retail investors, such as ETFs that track companies that have exposure to blockchain technology. These may be a more direct route to investing in blockchain.

When a new cryptocurrency gets created, oftentimes the developers hold an initial coin offering, or ICO, which allows people to purchase the tokens early in order to support the project and get a good price before the project launches.

ICOs, similar to initial public offerings of stock (IPOs), can be accompanied by a fair amount of public discussion about the merits of the new coin, and the technology it’s built on. For investors interested in finding the next blockchain investment for their portfolios, an ICO could provide an interesting opportunity.

While this point was addressed above, it’s important to underscore that there are thousands of different types of cryptocurrencies that investors can buy and sell, each one with its own dedicated blockchain.

Unlike traditional fiat currencies, which are used as a means of exchange and a store of value, crypto often serves multiple functions on its dedicated blockchain. This is another reason to invest in crypto as a way to invest in various blockchains.

When it comes to investing in blockchain technology stocks, there are a lot of options. The blockchain ecosystem is complex, involving developers, exchanges, miners, data, security, and more. There are also companies that aren’t directly making blockchain technology, but are using it for their existing business to streamline systems and increase efficiency. These include large corporations such as Walmart, Starbucks, IBM, Meta, and Amazon.

Buying shares in blockchain companies can be a great long-term strategy, since this industry is just getting started. Here are some of the subcategories of blockchain that one could invest in:

Decentralized Finance

Decentralized Finance (DeFi) shifts the control of financial transactions away from centralized financial institutions, such as banks. The goal of DeFi is increased transparency and efficiency, lower fees, and putting people in charge of their own money. Examples of DeFi include crypto wallets, peer-to-peer lending, and cryptocurrency exchanges.

DeFi wouldn’t be possible without blockchain technology. By investing in different aspects of the DeFi space, investors are essentially investing in the relevant blockchains and blockchain technology that supports these financial innovations.

Financial Technology

Related to the above: Financial Technology (Fintech) is a type of technology that improves upon financial services.

Blockchain technology plays a big role in fintech, as it is being used to revolutionize all aspects of legacy finance, from banking to lending and transacting.

Metaverse

The metaverse is essentially where the digital world intersects the material world. It includes technologies such as virtual reality, augmented reality, and online interactive virtual worlds. Users engage in immersive and interactive experiences for education, work, entertainment, and socializing.

Not everything in the metaverse uses blockchain technology, but many companies, such as game developers and social media platforms, are using cryptocurrency tokens within their virtual worlds, or recording data and transactions from those worlds on the blockchain. In other words, investing in the metaverse is essentially investing in blockchain technology.

Exchanges

Another way to invest in blockchain by investing directly in cryptocurrencies is to invest in stocks of cryptocurrency exchange companies, such as Coinbase (COIN). Exchanges allow people to buy, sell, and exchange different cryptocurrencies. Coinbase is a popular cryptocurrency exchange that is publicly traded on the Nasdaq.

Blockchain and Health Care

Blockchain is revolutionizing the health care system, and this transition is only just beginning. Blockchain can help with secure and efficient sharing of sensitive patient data, allowing health information to be used both within organizations and across the broader medical system. It can also help with healthcare contracts and negotiations, including healthcare insurance.

Non-fungible tokens (NFTs) are cryptographic digital assets. Their data is stored on the blockchain, ensuring that they can’t be replicated or forged.

Pretty much anything can be tokenized, from real estate to music to art. Currently, most of the NFT market is focused on collectibles like sports cards and digital art. But there are other highly priced NFTs on the market, such as a tokenized version of the first-ever tweet.

Individuals can purchase NFTs and resell them for a profit if their value increases.

Blockchain technology has become a tech sector that many investors may want to consider. For those wondering how to invest in blockchain, there are multiple opportunities, from trading crypto itself (which gives investors exposure to that crypto’s underlying blockchain), to investing in companies that are developing new uses for blockchain in many areas: health care, law, real estate, finance, international trade, and more.

Buying shares in blockchain companies can be a great long-term strategy, since this industry is just getting started. While you can’t invest directly in a blockchain (blockchain is the digital infrastructure organizations use to run various operations), you can invest in companies that use blockchain for decentralized finance, to run crypto exchanges, to create smart contracts, NFTs, and more.

No. Blockchain is a technology that is used for many purposes. There is no way to invest directly in a blockchain, but there are many ways to invest in companies developing and using blockchain technology.

You can potentially make money from blockchain by investing in stocks or ETFs focused on blockchain companies, purchasing individual cryptocurrencies, or initial coin offerings (ICOs).

Blockchain technology can be used for anything that requires a digital, append-only, immutable ledger of transactions or data storage. This includes money transactions, real estate transactions, voting records, supply chain tracking, and more.

Photo credit: iStock/Poike

SoFi Invest® INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , and the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

2Terms and conditions apply. Earn a bonus (as described below) when you open a new SoFi Digital Assets LLC account and buy at least $50 worth of any cryptocurrency within 7 days. The offer only applies to new crypto accounts, is limited to one per person, and expires on December 31, 2023. Once conditions are met and the account is opened, you will receive your bonus within 7 days. SoFi reserves the right to change or terminate the offer at any time without notice.

First Trade Amount

Bonus Payout

Low

High

$50

$99.99

$10

$100

$499.99

$15

$500

$4,999.99

$50

$5,000+

$100

SOIN0422045

That end of 2021 saw a Bitcoin bull run like few assets have ever had — and then for most of 2022 that bull run came to a crashing halt for Bitcoin and for countless other cryptocurrencies.

To the extent that Bitcoin is the oldest and largest cryptocurrency, it can be something of a market leader — or it has been lately, with many other cryptos also succumbing to the long “crypto winter” of 2022.

The price of Bitcoin (BTC) started 2021 at around $30,000, only to more than double and hit north of $60,000 by mid-April. After falling again, it then spiked back up to nearly $68,000 in November 2021, marking two dramatic bull runs within a calendar year.

All that said, 2022 has been quite a different story, with BTC prices falling below $20,000 — and cryptocurrencies like Ethereum (ETH) and Dogecoin (DOGE), showing similar dramatic drop-offs in value. Now the big question for crypto traders is whether they can expect another crypto bull run in 2023.

Let’s take a look at some of the key indicators, crypto predictions, and possibilities for Bitcoin and other cryptocurrencies during the next few months.

Table of Contents

While it’s hard to accurately make Bitcoin projections — or crypto predictions in general — a look back at Bitcoin’s recent history may be helpful in determining if another bull run is ahead for BTC, and potentially other crypto.

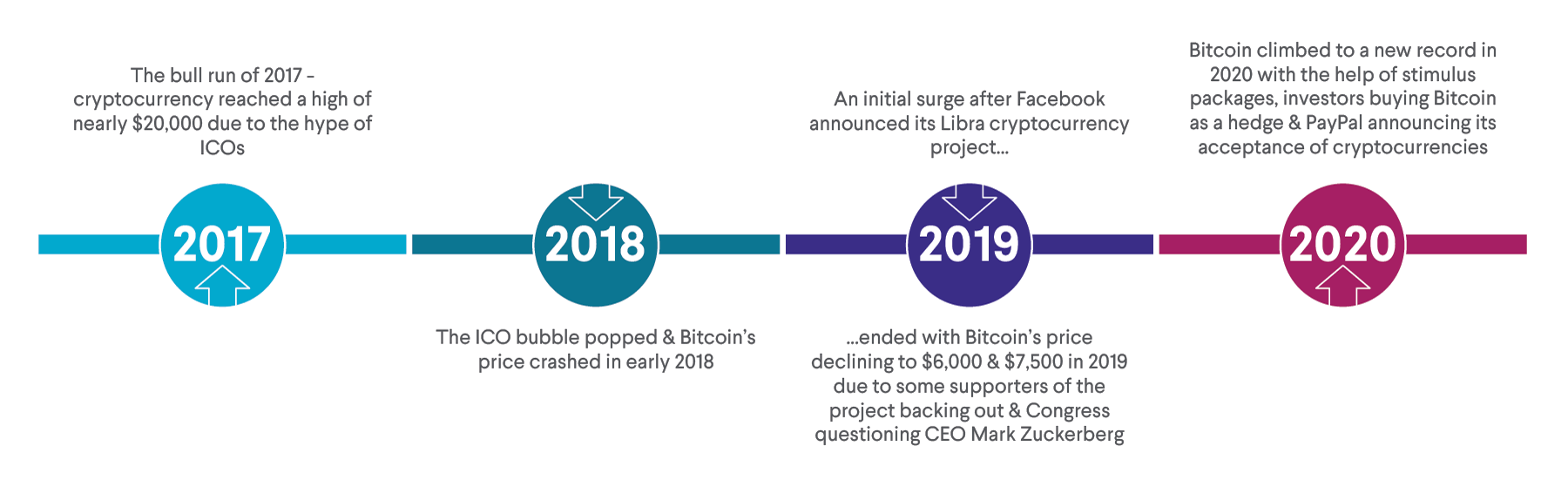

Bitcoin investors likely remember the bull run of 2017, during which the cryptocurrency reached a valuation of nearly $20,000. Much of that rally was fueled by hype over several initial coin offerings (ICOs) — including Brave and Kik — and people who hoped to benefit from rising prices in the short term.

ICOs are when companies raise funds by issuing new tokens to investors who become backers of the blockchain project. But after the ICO bubble popped in early 2018, Bitcoin’s price subsequently crashed. While many of today’s top cryptocurrencies didn’t yet exist, a few also stumbled at this time, including ETH, DOGE, and ADA.

This wasn’t surprising to many experts, who often say that the cryptocurrencies markets are likely to be turbulent, as they fight for credibility.

In 2019, Facebook announced its Libra cryptocurrency, which contributed to another Bitcoin rally, with values topping out at around $11,000. However, when some supporters of the Libra project backed out and Congress questioned CEO Mark Zuckerberg about regulatory concerns, Bitcoin’s price declined to $6,000 and $7,500 during the second half of 2019, along with many other cryptocurrencies. The Libra project, renamed Diem, has since shuttered.

Bitcoin climbed to a new record in 2020, as stimulus packages, meant to prop up economies during the Covid-19 pandemic, led to money finding its way into fringe markets like cryptocurrencies.

However, there were also signs that different types of cryptocurrencies were gaining wider mainstream acceptance. Prominent investors announced they were buying Bitcoin as a hedge, and payment providers like PayPal announced they would allow customers to use cryptocurrencies.

Accordingly, the crypto markets gained steam. That was led by Bitcoin, which saw its value break its previous high-mark of $20,000 in December 2020. Then, during the first several months of 2021, the bull run continued until Bitcoin hit more than $61,000. Its value did fall to less than $30,000 in the subsequent months, but that drop was a precursor to another bull run.

Between July and October 2021, Bitcoin again saw its value soar, hitting almost $67,000. But after that, its value fell. The economic climate, including high inflation and drops in the stock market, have coincided with a bear run for Bitcoin, and as of November 4, 2022, Bitcoin was trading at around $20,000.

Numerous factors affect the price of any crypto, including Bitcoin, and since it is a global currency, Bitcoin’s value can be affected by events around the world. No central actor or authority determines the price of most crypto; it’s set by the market, and by supply and demand from traders and investors. The price can also vary from one exchange to another.

The main factor that determines any crypto’s price is whether investors want to buy or not, or what we typically refer to as “demand.” If good news comes out about Bitcoin or other cryptocurrencies, or bad news comes out about another type of investment, that can cause people to buy Bitcoins (increase demand) and hike the price up.

Conversely, bad news about cryptocurrencies can cause people to sell. News doesn’t necessarily have to be overtly negative to spook the market, either.

Similarly, the rules of supply and demand affect the Bitcoin market. Only 21 million Bitcoins will ever be created, and if investors see a strong long-term market for Bitcoin, they may want to own a piece of the pie.

💡 Recommended: Why Is Bitcoin So Volatile?

Although Bitcoin is the biggest and likely most well-known cryptocurrency, there are thousands of other altcoins available on the market. When good news comes out about other projects, may investors sell off some of their Bitcoin to purchase altcoins.

Also, new projects offer ICOs which can sometimes have a high return in a short amount of time. If a promising ICO comes to market, it might draw attention away from Bitcoin.

Both large financial institutions and individual investors can have an effect on the market. Some crypto holders, known as “whales,” own a significant enough amount of a particular crypto that they can move its price if they make a large purchase or sale.

The main costs associated with producing Bitcoin are electricity and mining equipment. Although Bitcoin is a digital currency, it must still be mined. The way Bitcoin is designed, only about one block on Bitcoin’s blockchain network can be mined every ten minutes.

If more miners join the network, the more competitive mining becomes, which makes the cost of producing each Bitcoin more expensive. Miners have to invest in new, faster equipment and are less likely to receive a pay out. These costs can have an effect on Bitcoin’s price.

💡 Recommended: How Does Bitcoin Mining Work?

Each country has different definitions and regulations for Bitcoin and cryptocurrencies, or none at all. When news comes out about regulatory decisions, it can cause investors to buy or sell. It is important to note that cryptocurrency is currently unregulated in the United States, though that’s likely to change in the coming years.

Cryptocurrencies faced regulatory hurdles in the U.S. in 2021. The Securities and Exchange Commission rejected several applications for a Bitcoin exchange-traded fund, damping hopes that an ETF version of the cryptocurrency will be trading on U.S. stock exchanges anytime soon. In September 2022, the Biden administration released a first look at potential crypto regulations framework.

In addition, cryptocurrencies experienced volatility after China clamped down on the market, issuing warnings about trading and mining.

💡 Recommended: Are There Bitcoin ETFs?

Crypto has become the preferred currency for many people around the world who may not have access to banking, or who are living in a country going through a fiat currency crisis.

In Venezuela, for example, Bitcoin’s popularity has grown as inflation and sanctions have resulted in the devaluation of the Venezuelan Bolivar. El Salvador, too, even went so far as to make Bitcoin its official legal tender in 2021.

💡 Recommended: Take a closer look at what fiat currency is.

The same market forces that determine the value of Bitcoin can and do drive value for the crypto market as a whole. Supply and demand is obviously the key driver, but there are a few other key things at play as well.

As mentioned, investor demand is perhaps the primary driving force propelling values in the crypto market overall. This will likely become more apparent as the crypto space grows over time; more coins or tokens will likely be created, but they won’t all be in demand. As such, their values will likely remain low.

Demand can be spurred by the expected growth, in value or in market cap, of the crypto space. If investors expect the crypto market, as a whole, to grow, they might be inspired to buy cryptocurrencies in anticipation of that growth, with the idea being that they’re “getting in early” on an investment. That, in turn, increases demand.

The markets owe a lot to sentiment. If people are pessimistic about the future, they may be less willing to spend or invest money. Conversely, if they’re optimistic, they may be looking to invest or prepare for what’s ahead. For example, if they expect the crypto market to grow, as mentioned, they’re feeling optimistic about the space, and increase demand for tokens, driving the market higher.

A final factor that may play a role in determining the crypto market’s performance is how well conventional markets are performing. If investors are not getting their desired returns from the stock market, they may be looking at alternatives to generate those higher returns. Over the past few years, the high returns and growth in the crypto space has been an obvious candidate. As more investors pile into the crypto market, the higher the demand, and thus, the higher valuations can go.

However, as we’ve seen, the crypto market is very volatile, and presents big risks for investors chasing high returns.

While there are big economic factors at play that have led to Bitcoin’s decline during 2022, a few other factors have been holding it back from seeing bigger, significant growth in recent years.

Since Bitcoin is a relatively new technology, it takes time for companies to build up tools and use cases for it. At this point, the infrastructure is getting stronger and it’s easy for novice investors to buy and sell Bitcoin at the touch of a button.

However, many people holding Bitcoin don’t own it because they plan to use it for everyday purchases, but rather, because they view it as a long-term, safe-haven investment with a lot of potential upside. It should be noted, again, that investing in Bitcoin and other cryptocurrencies is inherently very risky.

Traditionally, there haven’t been many retailers that would accept Bitcoin. Now, you can use bitcoin or other cryptocurrencies at Starbucks, Amazon, Nordstrom, and many other retailers. Retailers may change their policies, however, which is something to keep in mind.

Experienced investors tend to be very careful about what they invest in. If an asset doesn’t have clear legal regulations and guidelines, they may not choose to take the risk of investing in it. As mentioned, the Biden administration has outlined some frameworks for regulating the crypto space, and it’s likely that formal rules will be introduced in the next few years.

If large corporations start holding some of their wealth in Bitcoin, or financial institutions otherwise demonstrate support of cryptocurrencies, that could add legitimacy, which could drive new investors to the market.

A survey released in 2021 by Fidelity Digital Assets found that 52% of institutional investors — which could include pension funds, family offices, investment advisers and hedge funds — owned digital assets like Bitcoin.

However, a separate survey by JPMorgan released in 2021 found that 78% of institutional investors are not planning on investing in crypto. However, the survey also found that a majority also think crypto is “here to stay.”

A combination of economic headwinds, mostly related to the Covid-19 pandemic, seemingly crashed together in early 2022, slowing the economy, driving up inflation rates, and dragging down the value of stocks, precious metals, and even the crypto markets.

Between May and June 2022, the crypto markets lost roughly $1 trillion in value. It’s hard to say what, exactly, caused it. But as mentioned, asset classes of all types saw similar drawdowns. In what is now being called the “crypto winter,” the down market has persisted into the second half of 2022.

Bitcoin was not spared from the ongoing crypto winter. You need look no further than the massive drop in Bitcoin’s value to see the effects: Bitcoin started the year trading at nearly $48,000, but by the middle of June, was trading at less than $19,000.

Bitcoin’s value was just one victim of the market’s crash; the crypto market as a whole went down with it. Again, the crypto market crash, and subsequent flattening between the beginning of 2022 and the end, as trillions of dollars in value were wiped out in a manner of months. All of the major coins were affected, too, including Ethereum. Some stablecoins were destabilized, too.

A few crypto firms and related financial firms even went belly-up as well.

Non-fungible tokens, or NFTs, also saw their value effectively wiped out during the first part of 2022. After NFTs saw a huge bull run in 2020 and 2021, as investors bought into the hype, the average price of NFTs nosedived in 2022. In fact, the average price of NFTs fell from nearly $4,000 to less than $300 in just a couple of months, a similar downward trajectory to what was seen among many cryptocurrencies.

It’s easy to look at most of 2022 and walk away convinced never to invest in the crypto space after such a monumental drop in value. But it’s important to remember that this year has seen a rare combination of both global events and economic headwinds leading to an overall downturn.

That said, there are some things to keep an eye on to try and get a read on what might happen in the crypto space during the remainder of 2022, heading into 2023.

The U.S. continues to face a number of major economic and sociopolitical unknowns. There are midterm election results to deal with, rising interest rates, high inflation, and the prospect of a recession, for instance. And in many respects, the economy is still recovering from the pandemic.

It’s hard to say how that might affect Bitcoin, but some economists believe that a U.S. recession could be rocket fuel for a Bitcoin bull run. If investors lose faith in the U.S. dollar and the stock market, they may turn to the cryptocurrency market once again as a safe haven. Although, to be fair, it hasn’t proven to be much safer than the stock market this year.

Some technical indicators could signal that Bitcoin is heading towards a bull run, but technicals are not always trustworthy predictions. Depending on how you combine charts and analysis, which likely will involve some advanced knowledge and skill, the market can also look like it’s heading towards a downward spiral.

As mentioned, China has been cracking down on the cryptocurrency market, causing volatility in prices. Meanwhile, the U.S. government is already discussing future rules and regulations for the crypto space. The Biden administration has made it clear that regulation is coming, but it’s also worth noting that changes to the composition of Congress after the midterm elections may disrupt things.

Numerous countries are considering developing or already working on their own digital currencies and stable coins. The U.S., Russia, India, and France and other nations have announced plans to enter the digital currency market. In addition to several Caribbean nations, China is probably the farthest along out of the major economies, having launched a central bank digital currency (CBDC).

As these projects progress, they could add legitimacy to the market and challenge some fiat currencies. Bitcoin’s price may go up in the short term as these announcements come out, but whether its value will hold in the long run as the world transitions towards digital currency has yet to be seen.

Of course, Bitcoin is not the only game in town, and other crypto projects are giving it a run for its money.

Another top-tier cryptocurrency is Ethereum. Ethereum has had a boom given the interest in NFTs, which often take the form of digital versions of art or collectibles that are linked to a blockchain , which is one of the many potential uses of blockchain.

Dogecoin had a meteoric rise in 2021, mostly fueled by social platforms that have also been behind the rallies of meme stocks like GameStop and AMC. Elon Musk was a proponent before an appearance on the TV show Saturday Night Live, when he called Dogecoin a “hustle.” Since such developments, the price of Dogecoin has suffered, losing much of its value.

As is the case with any investment, it’s crucial for investors to do their own research and take expert predictions with a grain of salt. The cryptocurrency market is still in its infancy relative to other markets, so there isn’t much data to go on when making predictions, and unpredictable circumstances can have significant effects on the market.

Bitcoin is a risky investment. Investors should consider making their own decisions about their level of risk based on a proper analysis of all the various factors that come into play.

Finally, remember that the past is not a prediction of the future, and just because trend lines indicate a bull run is coming doesn’t mean they’re correct. In such a complex, fast-changing market, it’s important to stay informed and do due diligence.

2022 has been an eventful year for cryptocurrencies, although not in a way that most investors would have liked. The crypto market has lost a lot of value, but that doesn’t mean a bull run couldn’t be around the corner — especially when you consider the rise and fall of crypto values across the board, over the last decade or so.

For keeping track of the market, buying crypto, or buying and selling more traditional assets, using a streamlined secure app might be the way to go.

It’s difficult, if not impossible to say, given that the crypto markets have only been in operation for a little more than a decade. The market has experienced bull and bear markets during that time, but it’s likely too early to determine what a “typical” bull run’s duration could be.

Expert opinions are all over the place, with some people predicting another massive bull run for Bitcoin, while others thinking that it’ll continue to dwindle. Nobody knows for sure. Prospective investors should be prepared to stomach big losses, though, if they’re willing to chase big potential gains.

There’s no limit to how high Bitcoin’s price could go, with some people thinking that it could top six-figures at some point in the future. Again, nobody knows what will happen, so just as Bitcoin’s price could soar, it could also drop further.

SoFi Invest® INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

Crypto: Bitcoin and other cryptocurrencies aren’t endorsed or guaranteed by any government, are volatile, and involve a high degree of risk. Consumer protection and securities laws don’t regulate cryptocurrencies to the same degree as traditional brokerage and investment products. Research and knowledge are essential prerequisites before engaging with any cryptocurrency. US regulators, including FINRA , the SEC , and the CFPB , have issued public advisories concerning digital asset risk. Cryptocurrency purchases should not be made with funds drawn from financial products including student loans, personal loans, mortgage refinancing, savings, retirement funds or traditional investments. Limitations apply to trading certain crypto assets and may not be available to residents of all states.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

2Terms and conditions apply. Earn a bonus (as described below) when you open a new SoFi Digital Assets LLC account and buy at least $50 worth of any cryptocurrency within 7 days. The offer only applies to new crypto accounts, is limited to one per person, and expires on December 31, 2023. Once conditions are met and the account is opened, you will receive your bonus within 7 days. SoFi reserves the right to change or terminate the offer at any time without notice.

First Trade Amount

Bonus Payout

Low

High

$50

$99.99

$10

$100

$499.99

$15

$500

$4,999.99

$50

$5,000+

$100

SOIN0622043

See what SoFi can do for you and your finances.

Select a product below and get your rate in just minutes.