A Beginner’s Guide to Investing in Your 20s

Deciding how to invest money in your 20s can seem overwhelming at first; many people have differing opinions or goals, and it’s hard to know where to start. But remember that you don’t need to have a lot of money upfront to be a successful and savvy investor.

Perhaps the most important thing is to start investing early, even if your initial investments are small. Here are a few different strategies for investing money in your 20s.

Think About Financial Goals

When determining your financial goals, you may want to break down short-, medium-, and long-term milestones. You want to ask yourself what you want from your money and figure out when you’ll need to use the money. For example, the money you save for a medium-term goal, like a down payment on your first home, should be treated differently than the retirement savings you won’t touch for 40 or more years.

So, you may want to start buying stocks right away, but you may also want to give some strategic thought as to how that may fit into your overall financial goals.

If you have not earmarked savings for a specific financial goal, take some time to think about what purpose you’d like to apply it to. A great first saving goal is to have three to six months of living expenses in an emergency fund. After that, it might be good to turn your attention toward savings and investing for longer-term goals, like retirement.

Decide Where to House Your Money

When deciding how to invest money in your 20s, it can help to think about immediate, mid-term, and long-term financial needs. Once you have outlined some money goals, you could consider setting up your accounts. The type of account you open often depends on when you need the money.

Where to Put Immediate Money

Food, bills, rent, and everything else you must pay for on a month-to-month basis are immediate needs. Often people keep this money — along with a cushion so as not to overdraft their account — in an online bank account. These types of accounts allow you to withdraw money instantaneously, generally without penalties, making them ideal for your immediate financial needs.

Where to Put Mid-term Money

Mid-term money is any money you might need in the next couple of years, such as a travel fund, wedding fund, or home down payment savings. It might make sense to keep this money in a high-yield savings account, which provides a better return on your money than traditional savings accounts.

High-yield savings accounts, along with other cash equivalents like certificates of deposits (CDs) and money market accounts, are usually considered to be lower-risk investments (though CDs are not helpful for emergency funds because of the early termination penalties).

Where to Put Mid- to Long-term Money

For money you’ll use in five to 20 years, you may be prepared to take slightly more risk than a high-yield savings account. You might choose to keep the money in your high-yield savings account or in CDs, or a online brokerage account where you can invest that money in stocks, bonds, mutual funds, or other asset classes. You can also do a combination of the different types of accounts.

Longer-term savings options, like a tax-advantage 529 plan, can also be appropriate if you’d like to start planning for higher education needs for current or future children.

Where to Put Long-Term Money

Think of long-term money as cash you won’t need for several decades. A retirement account is a great example of an appropriate place to hold long-term money. Retirement plans like a Traditional IRA, Roth IRA, or a 401(k) account can offer significant tax benefits.

💡 Ready to invest in your retirement? Consider opening a Traditional or Roth IRA with SoFi.

Potential Assets to Invest in During Your 20s

One important thing to understand about investing in your 20s is the tradeoff between risk and reward when implementing your investing strategy. You cannot have one without the other. With this risk and reward calculation in mind, you need to determine what asset classes you might consider when investing in your 20s.

Stocks

A stock is a tiny piece of ownership in a publicly-traded company. When you invest in a stock, you could earn money through capital appreciation, dividends, or a combination of the two.

Stocks can be volatile because prices fluctuate according to supply and demand forces as they trade on an open exchange. Even though stocks can be volatile and experience losses, they tend to provide positive returns over time. The S&P 500 index has had an average annual growth rate of 10.3% from 1957 through the end of 2023.

Bonds

Although not risk-free, experts generally consider bonds less risky (though not risk-free) than stocks because they are a contract that comes with a stated rate of return. Bonds backed by the U.S. government, called treasury bonds, are the safest within the category of bonds because it is unlikely that the U.S. government will go bankrupt.

Bonds are debt investments, meaning investors fund the debt of some entity. The money you earn on that investment is the interest they pay you for borrowing your money. In addition to treasuries and corporate bonds, there are municipal bonds, which state and local governments issue, and mortgage- and asset-backed bonds, which are bundles of mortgages or other financial assets that pass through the interest paid on mortgages or assets.

Mutual Funds and Exchange-Traded Funds

Some investors might want to utilize mutual funds or exchange-traded funds (ETFs) to gain exposure to certain asset classes.

A fund is essentially a basket of investments — stocks, bonds, another investment type, or a combination thereof. Funds are helpful because they provide immediate diversification: safety against the risk of having too much money invested in one stock, sector, or any other single asset.

Funds are either actively or passively managed. A fund that is passively managed is attempting to track a specific index. An actively managed fund is maintained with a hands-on approach to determine investments in a portfolio. ETFs tend to be passively managed, but there are many actively managed ETFs funds on the market. Mutual funds can be either passively or actively managed.

Tips for Investing In Your 20s

Once you’ve become familiar with the basics of investing, it’s time to put that knowledge into action. These tips can help you shape a strategy for how to invest money in your 20s and beyond.

Gauge Your Personal Risk Tolerance

One of the key things to remember about investing in your 20s is that time is on your side. You have a significant time horizon window to allow your portfolio to recover from bouts of inevitable stock market volatility. Because of this, you could take more risks with your investments to try and achieve higher rewards.

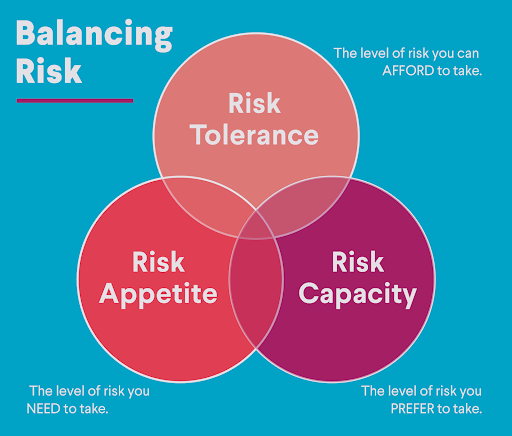

Getting to know your personal risk preferences can help you decide where and how to invest in your 20s to achieve your investment goals. It’s also important to understand how risk tolerance matches your risk capacity and appetite.

Risk tolerance means the level of risk you’re comfortable taking. Risk capacity is the level of risk you prefer to take to reach your investment goals, while risk appetite is the level of risk you need to hit those milestones. When you’re younger, playing it too safe with your portfolio might mean missing out on significant investment returns.

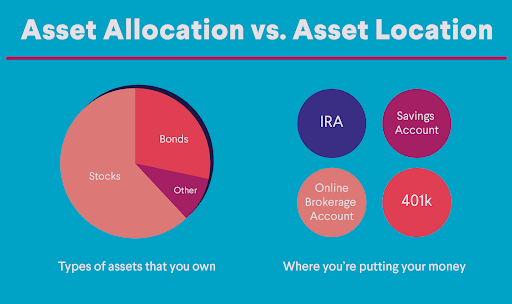

Know the Difference Between Asset Allocation and Asset Location

People often invest in a combination of stocks and bonds, which is easy to do using mutual funds and ETFs. One strategy for investing in your 20s is to invest a higher allocation of your long-term investments in stocks and less in bonds, slowly moving into more bond funds the closer you get to retirement. This big picture decision is called asset allocation.

But asset allocation is only part of the picture. One might also consider asset location: the types of accounts where you’re putting your money, like savings accounts, an online brokerage account, a 401k, or an IRA.

Asset location matters when it comes to investing money in your 20s because it can maximize tax advantages if you’re utilizing a 401k or IRA. But these retirement accounts also have restrictions and penalties for withdrawing money. So if you want to be able to access your investments quickly, an online brokerage may be a complimentary investing account.

Take Advantage of Free Money

One of the simplest ways to start investing in your 20s is to enroll in your workplace retirement plan like a 401k.

Once you’ve enrolled in a plan, consider contributing at least enough to get the full company match if your employer offers one. If you don’t, you could be leaving money on the table.

And if you can’t make the full contribution to get the match right away, you can still work your way up to it by gradually increasing your salary deferral percentage. For example, you could raise your contribution rate by 1% each year until you reach the maximum deferral amount.

Don’t Be Afraid of Investment Alternatives

Stocks, bonds, and mutual funds can all be good places to start investing in your 20s. But don’t count out other alternative investments outside these markets.

Real estate is one example of an alternative investment that can be attractive to some investors. Investing in real estate in your 20s doesn’t necessarily mean you have to own a rental property, though that’s one option. You could also invest in fix-and-flip properties, real estate investment trusts (REITs), or crowdfunded real estate investments.

Adding alternative investments such as real estate, cryptocurrency, and commodities to your portfolio may improve diversification and could create some insulation against risk.

The Takeaway

Learning how to invest money in your 20s doesn’t happen overnight. And you may still be fuzzy on how certain parts of the market work as you enter your 30s or 40s. But by continually educating yourself about different investments and investing strategies, you can gain the knowledge needed to guide your portfolio toward your financial goals.

One thing to know about investing in your 20s is that consistency can pay off in the long run. Even if you’re only able to invest a little money at a time through 401k contributions or by purchasing partial or fractional shares of stock, those amounts can add up as the years and decades pass.

If you’re ready to start saving and investing for your financial goals, the SoFi investment app can help. With SoFi Invest®, you can begin building a portfolio of stocks, and ETFs for as little as $5 to meet all the critical financial goals and milestones in your life.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

SOIN-Q324-034