How the Student Loan Interest Deduction Works & Who Qualifies

If you paid interest on your qualified student loans in the previous tax year, you might be eligible for the student loan tax deduction, which allows borrowers to deduct up to $2,500 in interest paid.

Here are some important things to know about the student loan interest deduction and whether you qualify.

Table of Contents

- How the Student Loan Tax Deduction Works

- Who Qualifies for the Student Loan Tax Deduction

- What Are the Income Requirements for the Student Loan Tax Deduction?

- Other Tax Deduction for Students

- Look for Form 1098-E

- Calculating Your Student Loan Interest Deduction

- Common Mistakes to Avoid

- Strategies to Reduce Student Loan Payments and Interest

Key Points

• Borrowers can deduct up to $2,500 in student loan interest annually.

• Eligibility requires being legally obligated to pay interest on a qualified student loan and not filing as married separately.

• Income limits for full deduction are based on a borrower’s modified adjusted gross income (MAGI), and MAGI limits are typically changed annually.

• Form 1098-E reports student loan interest a borrower paid over the year and is required for claiming the student loan interest deduction.

• Other education-related tax benefits include 529 Plans, the American Opportunity Tax Credit, and the Lifetime Learning Credit.

How the Student Loan Tax Deduction Works

With the student loan tax deduction, a borrower can deduct a certain amount of interest they paid on their student loans during the prior tax year.

The interest applies to qualified student loans that were used for tuition and fees; room and board; coursework-related fees like books, supplies, and equipment, and other necessary expenses such as transportation.

So how much student loan interest can you deduct? If you qualify for the full deduction, you can deduct student loan interest up to $2,500 or the total amount of interest you paid on your student loans, whichever is lower. (You don’t need to itemize in order to get the deduction.)

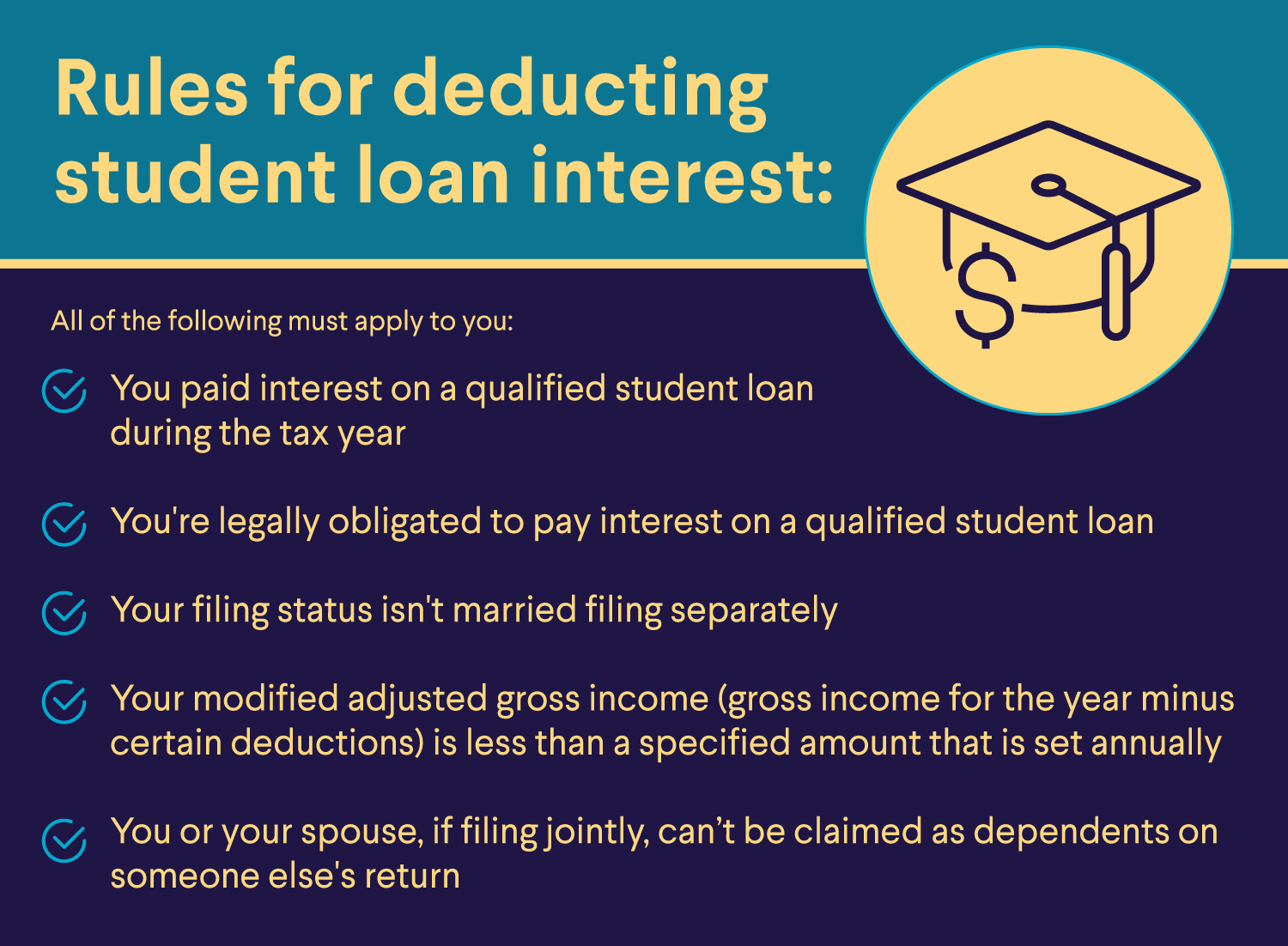

Who Qualifies for the Student Loan Interest Deduction?

To be eligible to deduct student loan interest, individuals must meet the following requirements:

• You paid interest on a qualified student loan (a loan for you, your spouse, or a dependent) during the tax year.

• Your modified adjusted gross income (MAGI) is less than a specified amount that is set annually.

• Your filing status is anything except married filing separately.

• Neither you nor your spouse can be claimed as a dependent on someone else’s return.

• You are legally required to pay the interest on a student loan.

The student loans in question can be federal or private student loans, as well as refinanced student loans.

What Are the Income Requirements for the Student Loan Tax Deduction?

The income requirements for the student loan tax deduction depend on your MAGI and your tax-filing status. The eligible MAGI ranges are typically recalculated annually.

For tax year 2024 (filing in 2025), the student loan interest deduction is worth up to $2,500 for a single filer, head of household, or qualifying widow/widower with a MAGI of $80,000 or less.

For those who exceed a MAGI of $80,000, the deduction begins to phase out. Once their MAGI reaches $95,000 or more, they are no longer able to claim the deduction.

For married couples filing jointly, the phaseout begins with a MAGI of more than $165,000, and eligibility ends at $195,000.

If you have questions about your eligibility, consider consulting a tax professional to make sure you can take advantage of the deduction.

When we say no required fees we mean it.

No late fees, & insufficient fund

fees when you take out a student loan with SoFi.

Other Tax Deductions for Students

In addition to the student loan interest rate deduction, there are other tax breaks that may be available to you if you’re a student, saving for college or paying for certain education expenses for yourself, a spouse, or a dependent. Here are three other tax benefits to consider:

529 Plans

A 529 college savings plan is a tax-advantaged plan that allows you to save for qualified education expenses — like tuition, lab fees, and textbooks — for yourself or your children. In 2025, you can contribute up to $19,000 per year without triggering gift taxes, and other family members can contribute to the fund, as well.

Savings can be invested and grow tax free inside the account. And while the federal government doesn’t offer any tax deductions, some states provide tax benefits like deductions from state income tax. Withdrawals must be used to cover qualified expenses; otherwise you will face income taxes and a 10% penalty.

American Opportunity Tax Credit

The American Opportunity Tax Credit (AOTC) helps offset $2,500 in qualified education expenses per student per year for the first four years of higher education. Unlike a tax deduction, tax credits reduce your tax bill on a dollar-for-dollar basis. And if the credit brings your taxes to zero, 40% of whatever remains of the credit amount can be refunded to you, up to $1,000.

To be eligible for the AOTC, you must be getting a degree or another form of recognized education credential. And at the beginning of the tax year, you must be enrolled in school at least half time for one academic period, and you cannot have finished your first four years of higher education at the beginning of the tax year.

Lifetime Learning Credit

The Lifetime Learning Credit (LLC) helps pick up where the AOTC leaves off. While the AOTC only lasts for four years, the LLC helps offset the expense of graduate school and other continuing educational opportunities. The credit can help pay for undergraduate and graduate programs, as well as professional degree courses that help you improve your job skills. The credit is worth $2,000 per tax return, and there is no limit to the number of years you can claim it. Unlike the AOTC, it is not a refundable tax credit.

To be eligible, you, a dependent, or someone else must pay qualified education expenses for higher education or pay for the expenses of an eligible student and an eligible educational institution. The eligible student must be yourself, your spouse or a dependent that you have listed on your tax return.

Look for Form 1098-E

If you’re wondering how to get the student loan interest deduction, keep an eye out for Form 1098-E, which you will need to file with your tax return. It will be sent out by your loan servicer or lender if you paid at least $600 in interest on your student loans for the tax year in question.

On Form 1098-E, your loan provider reports information on the interest you paid on your student loans throughout the year. The form goes out to student loan borrowers when the tax year ends, typically by mid-February. You can also check for the form on your loan servicer’s website and download a copy.

Note that you won’t receive this student loan tax form if you paid less than $600 in interest on your loan during the tax year.

Calculating Your Student Loan Interest Deduction

To figure out how much of a student loan interest deduction you can claim, start with your MAGI. If your MAGI is in the range to qualify for the full deduction, you’ll be eligible for $2,500 or the amount you paid in interest on your student loans during the tax year, whichever amount is less. (As you are calculating your MAGI, if you’re wondering, do student loans count as income, no, they do not.)

However, if your MAGI falls into the range where student interest deduction is reduced (which is more than $80,000 for single filers and $165,000 for joint filers in 2024), you can generally follow the instructions on the student loan interest deduction worksheet in Schedule 1 of Form 1040 to figure out the amount of your deduction when filing your federal income taxes. Then you can enter the calculated interest amount on Schedule 1 of the 1040 under “Adjustments to Income.”

One thing to note: For loans made before September 1, 2004, loan origination fees and/or capitalized interest may not be included in the amount of interest Form 1098-E says you paid. In this case, Box 2 on the form will be checked. If that applies to you, to calculate the full value of the interest deduction, start with the amount of interest the form says you paid, and then add any interest you paid on qualified origination fees and capitalized interest. Just make sure these amounts don’t add up to more than the total you paid on your student loan principal.

You can consult IRS Publication 970 for more information about how to do this, or consult a tax professional.

Common Mistakes to Avoid

Taking the student loan interest deduction can be somewhat complicated because there are a number of requirements involved. These are some common mistakes to watch out for.

• Misreporting your income. Be sure to calculate your modified adjusted gross income (MAGI) correctly. It’s critical to use the right MAGI when determining if you are eligible for the student loan interest deduction and how much you can claim.

• Deducting too much. The deduction is capped at $2,500 a year, no matter how much you paid in interest.

• Deducting interest paid by someone else. If another person made some of your student loan payments for you — your parents, say — you cannot deduct the interest they paid. You can only deduct the interest you paid.

• Failing to take the deduction. If you are eligible for the student loan interest deduction, be sure to take it. It can sometimes be easy to overlook this deduction in the hustle to get your tax information together.

Strategies to Reduce Student Loan Payments and Interest

Tax credits and deductions are one way to help cover some of the cost of school. Finding ways to lower your student loan payments is another cost-saving measure. Here are a few potential ways to do that.

• Put money toward student loans by making additional payments to pay down your principal. Doing this may help reduce the amount of interest you owe over the life of the loan. Just make sure your loan does not have any prepayment penalties.

• Make interest-only payments while you’re still in school on loans for which interest accrues, such as unsubsidized federal loans.

• Find out if your loan provider offers discounts if you set up automatic payment. Federal Direct Loan holders may be eligible for a 0.25% discount when they sign up for automatic payments, for example.

• Consider refinancing student loans. When you refinance, you replace your current student loan with a new loan that ideally has a lower interest rate or more favorable terms.

While there are advantages of refinancing student loans, such as possibly lowering your monthly payments, there are disadvantages as well. One major caveat: If you refinance federal loans, they are no longer eligible for federal benefits or protections. Also, you may pay more interest over the life of the loan if you refinance with an extended term. Weigh the options to decide if refinancing is right for you.

The Takeaway

Qualified student loan borrowers can take a student loan interest deduction of up to $2,500 annually. This applies to federal and private student loans as well as refinanced student loans.

You should get a form 1098-E from your loan servicer if you paid at least $600 in interest on your qualified student loans. Before you file for the deduction, make sure you qualify for it, and then figure out whether you are eligible for a full or partial deduction, based on your MAGI.

Whether you qualify for the student loan interest deduction or not, there are a number of ways to lower your monthly student loan payments, including putting additional payments toward your loan principal, signing up for automatic payments, and refinancing your student loans.

Looking to lower your monthly student loan payment? Refinancing may be one way to do it — by extending your loan term, getting a lower interest rate than what you currently have, or both. (Please note that refinancing federal loans makes them ineligible for federal forgiveness and protections. Also, lengthening your loan term may mean paying more in interest over the life of the loan.) SoFi student loan refinancing offers flexible terms that fit your budget.

FAQ

How much student loan interest can I deduct?

The amount of student loan interest you can deduct is the lesser of up to $2,500 annually or the amount of interest you paid on your student loans. However, to qualify for the full deduction in 2024, you must have a MAGI of $80,000 or less if you are a single filer, or $165,000 or less if you are filing jointly. You will be eligible for a partial deduction if your MAGI is less than $95,000 for single filers and less than $195,000 for joint filers. Keep in mind that the MAGI limits typically change yearly.

Do I need to itemize my deductions to claim the student loan interest deduction?

No, you do not need to itemize your deduction to claim the student loan interest deduction. The deduction is considered an adjustment to your income, according to the IRS, so there is no need to itemize. You can simply report the amount on Form 1040 when you file your taxes, and include a copy of your Form 1098-E, which shows the student loan interest you paid for the tax year.

Can parents deduct student loan interest if they pay for their child’s loans?

Parents who pay for their child’s student loans can deduct student loan interest only if they are legally obligated to repay the loan — meaning that the loan is in their name or they are a cosigner of the loan. However, if the loan is in the child’s name only, parents cannot take the deduction, even if they paid for their child’s loans. The rules can be confusing, so parents may want to consult a tax professional.

What happens if I refinance my student loans?

Refinanced student loans are eligible for the student loan tax deduction as long as the refinanced loan was used for qualified education expenses and your MAGI falls within the set limits.

Are private student loans eligible for the student loan interest deduction?

Yes, private student loans are eligible for the student loan tax deduction, as are federal loans and refinanced loans. As long as you paid interest on a qualified student loan, your MAGI is less than the specified limit for the year, your filing status is anything except married and filing separately, and you (or your spouse if applicable) can’t be claimed as a dependent on someone else’s return, you are eligible for the deduction as a private student loan borrower.

SoFi Student Loan Refinance SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOSLR-Q225-053

Read more