Guide to Houseboats: Definition and Key Characteristics

If you’re interested in living on a houseboat or just pleasure cruising, you’ll want to know the advantages and disadvantages of owning a houseboat.

Here’s a deep dive into the world of houseboats to help you understand what they are, how they work, and whether buying one is the right choice for you.

Table of Contents

Key Points

• Houseboats are designed primarily as dwellings on water, equipped with home-like features such as bathrooms, kitchens, and sleeping quarters.

• They are generally less seaworthy than regular boats and are meant for enclosed waters like lakes and rivers.

• Floating homes differ from houseboats in that they are stationary, lack mobility features, and are often larger and more expensive.

• Houseboats offer unique advantages such as reduced living costs and scenic views, but also have downsides like limited space and ongoing maintenance needs.

• Financing a houseboat is different from traditional home loans, with options including personal loans, marine loans, and using home equity products.

What Is a Houseboat?

A houseboat is a vessel built or modified to function primarily as a dwelling rather than just transportation.

When comparing houseboats to traditional boats, you can expect houseboats to have the features of a home, including one or more bathrooms, sleeping quarters, and a kitchen.

Houseboats, among the less common types of homes, are distinguished from other boats by their intended use as a dwelling.

Depending on how large the houseboat is and how much the owner is willing to invest, houseboats can range from barebones to luxurious.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

Characteristics of a Houseboat

A houseboat stands out in the fleet of traditional boats.

| Houseboats | Regular boats |

|---|---|

| Built or modified to function primarily as a residence | Built primarily for transportation or recreational purposes |

| Intended to function as a permanent shelter | Generally designed for transport or temporary accommodations |

| Less maneuverable than regular boats | Maneuverable and self-propelled in most cases |

Expect houseboats to be less seaworthy than boats specifically designed for transportation. The vast majority of houseboats are intended to be confined to lakes, rivers, and small bodies of water, not the open seas.

Houseboat vs. Floating Home

A houseboat and a “floating home” are different. Floating homes are meant to stay in one place, lacking an engine or navigation system. They usually have a floating concrete foundation.They’re generally much bigger than houseboats and cost more.

Even though some houseboats also dock in one place, most can motor to another location when needed or desired.

Houseboat Design

Houseboats may stretch from 20 feet to over 90 feet. A veranda or flybridge may help occupants make the most of outdoor views.

Hull design and materials vary. Here are some styles.

Pontoon: Flat-bottomed boat that’s supported by two to three floats, or pontoons, for buoyancy. This is common houseboat construction.

Full hull: Conventional boat hull with a large bilge that sits partly in the water and offers more space below deck.

Planing hull: Similar design to full hull but is designed to glide on top of the water at speed.

Catamaran hull: Parallel twin-hulled design that joins two hulls of equal size with a solid frame. The wide beam gives it better stability and handling.

Barge: Large flat-bottomed boat designed to handle heavy loads and operate in rivers and canals.

When researching the type of houseboat you want, you’ll want to make an informed choice when weighing livability and seaworthiness.

Pros and Cons of a Houseboat

It takes a special type of person to live on a houseboat. Here are some of the pros and cons of houseboat living to help you decide if you fall into this category.

Pros

• Reduced living costs: The lack of land to maintain means you won’t have to worry about shoveling snow or mowing the lawn. You can also expect lower utility costs due to the square footage, which could be enticing to people wanting to downsize their home.

• Nice views: You can’t get closer to waterfront living. Houseboat living offers the possibility of gorgeous lakeside or riverside views every day you wake up and go to bed.

• Water activities: Depending on the season and local ordinances, you may be able to fish, canoe, and enjoy all the perks of life on the water without having to take extra time off for a vacation.

• Lower rent or mortgage: Compared with the average stand-alone house, a houseboat may cost less to buy or rent.

• Possible tax advantages: Houseboat owners may not have to pay property taxes (although a deeded slip in some areas is considered real property), but they may live in a state, county, or city that imposes personal-property taxes. Also, the IRS says a boat can be your main or secondary residence, entitling you to take advantage of the same tax deductions as the owner of a typical house.

Cons

• Reduced living space: A modest houseboat may be smaller than most traditional homes.

• Marina or HOA fees: If you want to remain moored and plugged into the grid, you’ll need to pay slip fees or homeowners association fees.

• Maintenance: Expect to trade land maintenance expenses for boat maintenance costs. In some cases, you’ll need to find a contractor for repairs or an inspection.

• Lack of permanence: If you intend to sail from dock to dock, you’ll need to make compromises when it comes to having a permanent mailing address or regular friends and neighbors.

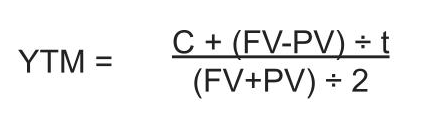

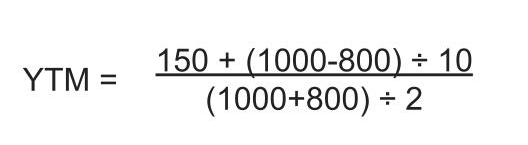

How to Finance a Houseboat

Used houseboats start at a few thousand dollars. New houseboats may range from $250,000 to $750,000.

Can you get a mortgage loan for a houseboat? No. But you may be able to get another kind of loan if you have a credit score in at least the “good” range on the FICO® credit rating scale and meet other lender criteria.

Some banks, credit unions, and online lenders offer boat loans. A marine loan broker can help you find and negotiate a boat loan, but the broker fee is often 10% or more of the houseboat purchase price. The loan might require 10% to 20% down. Note: SoFi does not offer boat loans, although it does offer personal loans, which are another financing option. Most personal loans are unsecured, meaning no collateral is needed.

A personal loan is another option. Personal loans of up to $100,000 are offered by a few lenders. Most are unsecured, meaning no collateral is needed.

A marine loan broker can help you find and negotiate financing, but the broker fee is often 10% or more of the houseboat purchase price. The loan might require 10% to 20% down.

If mortgage rates are ebbing, a cash-out refinance can work for some homeowners.

Other homeowners with sufficient home equity can apply for a home equity line of credit (HELOC) or home equity loan and use that money to buy a houseboat. The rate will typically be lower for an equity product using your home as collateral than that for an unsecured personal loan.

What if your credit isn’t good? So-called bad credit boat loans are afloat out there. They come with a high interest rate. Note: SoFi does not offer bad credit boat loans.

Just as you would shop around for the best mortgage loan offer, you will want to compare a number of houseboat financing options.

Finding a Houseboat to Buy vs. Building One

The cost of buying vs. building a house depends on size, location, the cost of labor and materials, and your taste, and the same holds true of houseboats.

Clearly, buying a used houseboat is almost always quicker and more convenient than trying to build one from scratch. However, if you have the knowhow to build your own houseboat, you’ll have much more freedom when it comes to how you want to design things.

If you’re deciding whether to buy or build a houseboat, you’ll want to consider your budget, time, availability, expertise, facilities, and tools.

Also consider how you would transport the houseboat from land to water when it’s done.

As for the question of time, most custom houseboat builds take months, if not more than a year, to complete. It’ll be much faster and easier to jump into houseboat living with an existing houseboat.

The Takeaway

Houseboats are a novel option for water lovers, including downsizers, retirees, and free spirits. Living on a houseboat can be cheaper than in a traditional home, but you’ll want to make sure you understand the advantages and disadvantages of living on a houseboat before committing. If you are ready to take the plunge, two options for financing your houseboat include a personal loan or a HELOC.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

FAQ

Can you live on a houseboat year-round?

Yes, but you’ll need to compensate for changes in the weather, particularly if the waters where you’re docked tend to freeze during the winter months. This includes ensuring that your houseboat is insulated and heated through the winter.

How long does it take to build a houseboat?

Construction could take 12 to 18 months to complete, depending on whether you’re building a custom houseboat on your own or enlisting the help of professionals.

Can you get a loan for a houseboat?

Yes, but not a traditional mortgage. Options include a boat loan, a personal loan, a home equity loan, and a HELOC.

How does a toilet work on a houseboat?

A marine toilet usually empties into a black-water holding tank until the boat reaches a marina pumping station, or the tank treats the waste and it’s eventually released in a designated discharge area. Noncruising houseboats usually have a hookup that takes out waste through a sewage line.

Photo credit: iStock/wayra

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHL-Q125-039

Read more