Budgeting For a New Dog

The United States is more than a little dog crazy: The percentage of households with a canine stands at 45.5%, meaning almost one out of two have a pooch. Owning a dog can be one of life’s great pleasures, whether you choose a tiny Chihuahua puppy or a mega, full-grown Great Dane as your new best friend.

But amid imagining all the cuddles and sloppy kisses, many prospective dog parents aren’t fully prepared for the expense of owning a pet.

This can be an important consideration, given that dog ownership generally requires a significant upfront and ongoing financial investment. Start-up costs tend to run around $2,127, while ongoing annual expenses average $2,489, according to the American Kennel Club.

If you’re considering bringing home a new pooch, here’s key information to know about budgeting for a dog.

Key Points

• The average annual cost to own a dog is $2,489.

• Adoption fees run between $50 and $500; breeder costs can be $800 to $4,000.

• Annual food costs range from $200 (for a small dog) to $720 (for a large dog).

• Pet insurance averages around $62 per month, providing emergency coverage.

• A $500 to $1,000 starter emergency fund is advised for unforeseen expenses.

8 Costs of Owning a Dog

It’s easy to fall in love with an adorable dog and feel as if you just must make it yours ASAP. But it’s wise to do a little research first about potential bills before you bring home a new pooch. Read on for eight costs that are likely to crop up.

1. Adoption Costs

The cost to adopt a dog varies depending on the organization, dog’s age, and breed, but fees from shelters can range anywhere from $50 to $500. The adoption fee helps cover some of the cost of holding the dog and getting them ready for adoption. At some pet rescues, adoption fees also cover the cost of veterinary services, like a pet physical exam, deworming, spaying or neutering, microchipping, and common vaccinations.

💡 Quick Tip: Tired of paying pointless bank fees? When you open a bank account online you often avoid excess charges.

Adoption vs Buying

Buying a dog from a breeder costs considerably more than adopting one from a shelter. Depending on the type of breed and the location of the breeder, you can expect to pay anywhere from $775 to $4,750.

The purchase price through a breeder typically includes the dog’s first round of shots and deworming. However, other medical costs — such as spaying or neutering and microchipping — are not typically covered by the breeder’s fee.

Recommended: 9 Cheapest Pets to Own

2. Food and Treats

Once you bring home your furbaby, you’ll also need to factor dog food and treats into your spending budget. The cost of feeding a dog can run anywhere from $200 per year for a small dog to $720 per year for a large dog. If you decide to serve your dog premium brands, freshly made food, or a specialized diet, your food costs could be significantly higher — as much as $3,000, possibly more, per year.

3. Toys

Toys may seem like a silly little add-on, but they can play an important role in puppy development and adult dogs’ mental stimulation. Toys can help dogs fight boredom when they are left at home alone and comfort them if they’re agitated. And with toys to gnaw on, dogs may be less likely to turn to shoes for a midday distraction.

One way to save money on pet costs is to keep toys simple. For example, a basic tennis ball will satisfy many dogs. And you can grab a can of three, fun-to-chase tennis balls for about $4. However, you may want to offer your new companion a range of fun things to play with. If so, you might set aside around $100 a year for doggie toys.

Increase your savings

with a limited-time APY boost.*

4. Pet Sitters or Walkers

If you work outside the home or plan to travel without Fido, it may be a good idea to factor in the cost of a dog walker or pet sitter. You can expect to pay between $24 and $34 for a 30-minute dog walking service. Hourly pet sitter rates can run anywhere $12 to $20 per hour, while the average cost to board a dog is around $40 per night.

It may be helpful to estimate how much outside care you’ll need for your new dog and add it to your budget.

💡 Quick Tip: Did you know online banking can help you get paid sooner? Feel the magic of payday up to two days earlier when you set up direct deposit with SoFi.^

5. Medical Visits

Dogs need regular medical care, so health expenses are another cost to consider when setting up your budget. Just like humans, dogs need blood drawn to check for diseases, routine vaccinations to prevent disease, and a general physical exam once a year to make sure their health is in working order.

The cost of healthcare for a dog varies widely depending on the type of dog, care provider, and where you live. On average, an annual vet visit can run $50 to $250, but that doesn’t include vaccinations (around $20–$80 per vaccine); medications and supplements ($10-$150 annually), and dental cleanings ($300-$1,500 annually).

6. Pet Insurance

While pet insurance won’t cover routine veterinary visits, it could come in handy if an emergency occurs with the pup. For example, a new dog could eat something that causes it to get sick or develop a bacterial or viral infection.

Many pet insurance plans will cover a portion of medicines, treatments (including surgeries), and medical interventions that aren’t tied to a pre-existing condition. The cost of pet insurance can vary significantly by your pet’s breed, age, and health history. On average, pet insurance for a dog runs around $62 a month.

💡 Quick Tip: Want a simple way to save more each month? Grow your personal savings by opening an online savings account. SoFi offers high-interest savings accounts with no account fees. Open your savings account today!

7. Incidentals

A lot of smaller expenses can come when you own a dog, such as doggy waste bags and cleaning supplies for pet-related messes. The ASPCA estimates that miscellaneous costs can average around $35 for small dogs, $45 for medium dogs, and $65 for large dogs annually.

8. Emergency Fund

It can be wise to save up an emergency fund for pet-related expenses. Having a financial cushion helps ensure you can make fast decisions about your pet’s care without worrying about how you’ll afford the bill.

You might set up a dedicated savings account to cover unexpected pet-related costs, with a goal saving between $500 and $1,000 to start. Or you could simply add to your general emergency saving fund. Either way, it’s a good idea to keep your emergency funds in a dedicated savings account, such as a high-yield savings account or money market account, so you’re not tempted to dip into it for everyday expenses.

The Takeaway

More than 45% of US households have dogs as pets, which shows how beloved they are. But before you get a pet, it’s important to know the costs involved (which can add up to thousands per year) and budget wisely. Saving in advance can make adopting and then caring for a dog easier. You might look for a high-yield savings account to help your money grow for this purpose.

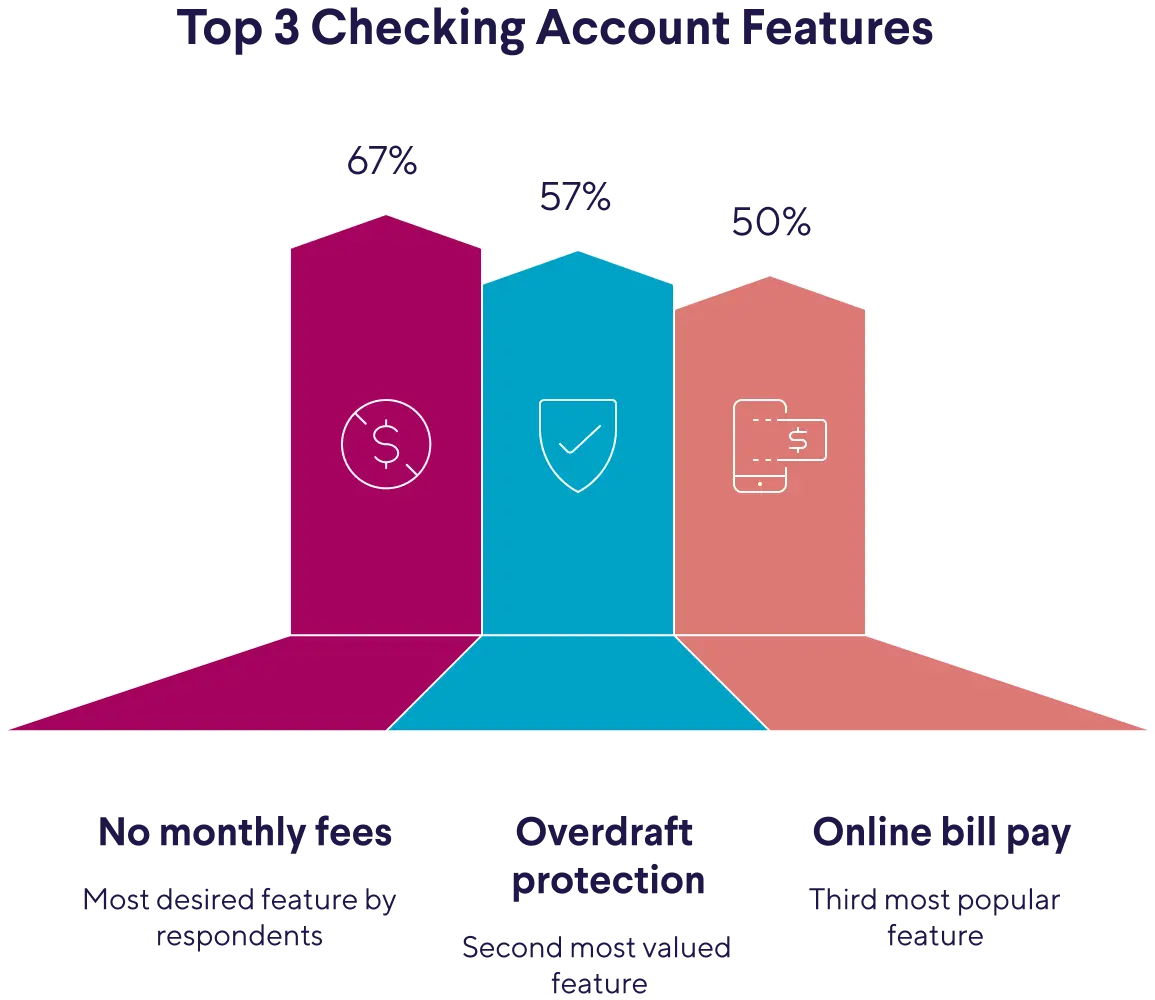

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

How much does it cost to buy a new dog?

The cost to buy a dog can vary widely depending on whether you adopt from a shelter or purchase from a breeder. Adoption is generally the more affordable option, with fees running anywhere from $50 to $500. The price for a puppy from a reputable breeder can run $775 to $4,750, depending on the breed’s popularity and rarity.

What is the monthly cost of owning a dog?

The average monthly cost of owning a dog ranges from approximately $64 to $248, depending on factors like size, breed, and location. These costs include food, toys and accessories, pet insurance, and grooming.

Can pet insurance save me money?

Buying pet insurance can be worth it if your pet is young and healthy or you don’t have enough savings to cover an expensive vet bill. However, it may not be a good deal if your pet is older or has health issues and/or you would be able to manage a hefty vet bill if it came up.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

^Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

SOBNK-Q425-031

Read more