What Can You Use Student Loans For?

Student loans are meant to be used to pay for your education and related expenses so that you can earn a college degree. Even if you end up with more student loan money than you need, it doesn’t mean you should use student loans for living expenses that are nonessential.

By learning the answer to the question what can you use student loans for?, you can make wise use of your money and potentially end up in a stable financial situation after graduation.

Key Points

• Student loans are designed to be used for expenses related to a borrower’s education, such as tuition and fees, housing, and books and supplies.

• For students who live off campus, student loans can be used to cover rent and utilities.

• Transportation expenses to and from school are considered an eligible expense for student loans.

• Student loans cannot be used for nonessential expenses, such as vacations, movie or concert tickets, or gym memberships.

• Borrowers who receive a student loan refund may want to send those extra funds back to their loan servicer, rather than spending, to save money on what they’ll owe after graduation.

What Can You Use Student Loans For? (5 Eligible Expenses)

Here are five things you can spend your student loan funds on to help pay for college.

1. Tuition and Fees

The first thing your student loans are intended to cover is your college tuition and fees. The average college tuition and fees for a private institution in the U.S. is $38,421 per year, while the average for a public, out-of-state school is $28,445 per year, and a public, in-state school is $9,750 per year.

2. Books and Supplies

Beyond tuition and fees, student loans can be used to purchase textbooks and supplies, such as a laptop, notebooks and pens, and a backpack. You may be able to save money by purchasing used textbooks online or by renting textbooks instead of purchasing them.

3. Housing Costs

If you’ve been wondering, can you use student loans for rent?, you’re in luck : Your student loans can be used to pay for housing costs, whether you live in a dormitory or off-campus. If you choose to live off-campus, you can put your loans toward your rent as well as related expenses, such as your utility bills.

Compare the costs of on-campus vs. off-campus housing, and consider getting a roommate to help cover the costs of living off-campus.

4. Transportation

If you have a car on campus or you need to take public transportation to get to school or an internship, you can use your student loans to pay for those costs. If you have a car, you may want to consider leaving it at home when you go away to school. Gas, maintenance, and a parking pass could end up costing much more than using public transportation and your school’s shuttle, which should be free.

5. Food

When it comes to using student loans for living expenses, food qualifies as a valid expense. That includes meals you cook yourself or your school’s meal plan. Instead of eating out or getting takeout frequently, you could save money by cooking at home, splitting food costs with a roommate, and asking if local establishments have discounts for college students.

Recommended: 23 Tips on Saving Money Daily

What Not to Use Student Loans For (5 Ineligible Expenses)

Now that you know what student loans can be used for, you’re likely wondering what they should not be used for. While your lender is probably not tracking your expenses, it’s not wise to use student loans for non-school related expenses. Remember, you will eventually have to pay this money back, with interest.

Here are five expenses that should not be covered with funds from your student loans.

1. Entertainment

Going to movies and concerts are part of the college experience, but you should not use your student loans to pay for your entertainment. Your campus likely offers plenty of free and low-cost entertainment events, such as sports games and campus movie nights. You can also consider getting a job on campus to help pay for entertainment and fun.

2. Vacations

College can be a lot of work, and you deserve a vacation from the stress every once in a while. However, if you can’t afford to pay to go away for spring break or another type of trip out of your own pocket, then you should put it off. It’s never a good idea to use your student loans to cover these expenses.

3. Gym Membership

You may have belonged to a gym at home before you went to college and want to keep up your membership there. You can, as long as you don’t use your student loans to cover the cost. Many colleges and universities have a gym or fitness center on campus that is available to students and included in the price of tuition.

4. A New Car

Even if you need a new car, student loans cannot be used to buy a new vehicle. Consider taking public transportation instead.

5. Extra Food Costs

While you and your roommates may love pizza, it’s not a good idea to use your student loan money to cover the cost. You also shouldn’t dine out too much with your loan money. Stick to eating at home or in the dining hall, and only going out to eat occasionally with your own money.

Student Loan Spending Rules

The amount of financial aid a student receives is based largely on each academic institution’s calculated cost of attendance, which may include factors like your financial need and your Student Aid Index, or SAI. Your cost of attendance minus your SAI generally helps determine how much need-based aid you’re eligible for. To determine how much non-need-based aid you may get (such as federal Direct Unsubsidized Loans, for instance), the school subtracts the financial aid you’ve already been awarded from the cost of attendance.

When you take out student loans, you sign a promissory note outlining what you’re supposed to be spending your loan money on. Those restrictions may vary depending on what kind of loan you received — federal or private, federal subsidized or unsubsidized. If the restrictions aren’t clear, it’s a good idea to ask your lender, “What can you use student loans for?”

Sometimes, students may end up with a student loan refund, which is what’s left after scholarships, grants, and loans are applied toward tuition, campus housing, fees, and other necessary charges. If you don’t need the refund for education-related expenses, it’s a good idea to send it back to your loan servicer. Just contact them and they’ll give you instructions for how to return the money. That way, you’ll have less to repay later, after you graduate.

Alternatives to Using Student Loans

Student loans help make college affordable, but you may not need to cover all of your tuition and living expenses with loans. Here are some alternative ideas to help fund your college education:

Work Part-time While in School

While working and attending college is not easy, it’s possible. According to one recent survey, 68% of students maintain a job while in school. Working is a way to pay for additional living expenses and potentially reduce your student loan debt and.

Apply for Scholarships

There are thousands of scholarships available for many different types of students — it’s just a matter of locating them. Putting in the time to find a scholarship, apply, and hopefully, get awarded, may save you thousands of dollars in tuition over the course of your college years.

Attend a Community College

One of the best ways to cut down on the cost of college and reduce your student loan debt is to choose a less expensive route, such as a community college or in-state institution. The average cost of community college is $3,598 per year for in-state students. Consider taking the prerequisites you need at a local community college and then transferring to an in-state public university.

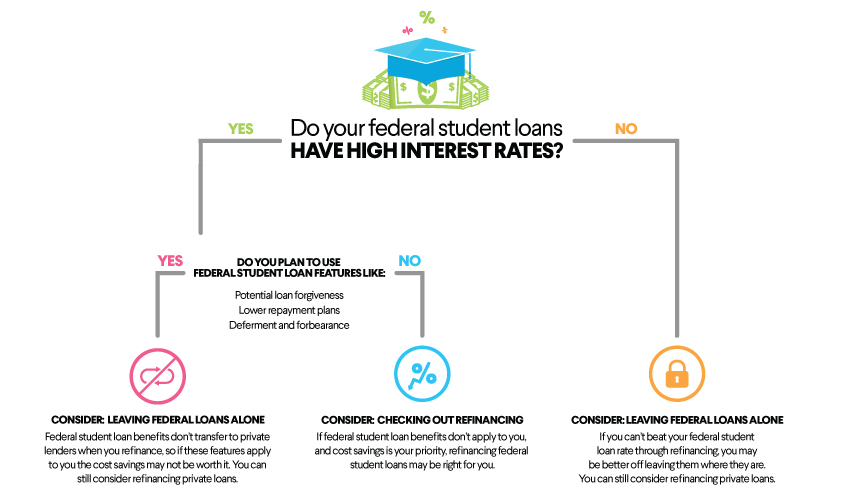

Refinancing Student Loans

If you’re interested in adjusting the terms of your student loans or securing a new interest rate, you may want to explore the option to refinance student loans. With refinancing, you trade your existing loans for a new loan from a private lender.

Refinancing can allow qualifying borrowers to secure a lower student loan refinancing rate or more favorable loan terms, which could potentially save them money over the long run.

A student loan refinancing calculator can help you determine if refinancing makes sense for you financially.

Just be aware that refinancing federal loans makes them ineligible for federal borrower benefits and protections, including federal deferment options and income-driven repayment plans. If you think you might need these benefits, refinancing probably isn’t the right choice for you.

Recommended: Student Loan Consolidation vs. Refinancing

The Takeaway

Student loans are meant to be used to pay for qualifying educational expenses such as tuition and fees, room and board, supplies, transportation, and food. Expenses like entertainment, vacations, and cars cannot generally be paid for with student loans.

Looking to lower your monthly student loan payment? Refinancing may be one way to do it — by extending your loan term, getting a lower interest rate than what you currently have, or both. (Please note that refinancing federal loans makes them ineligible for federal forgiveness and protections. Also, lengthening your loan term may mean paying more in interest over the life of the loan.) SoFi student loan refinancing offers flexible terms that fit your budget.

FAQ

Can you use student loans for rent?

Yes, you can use student loans for rent while attending college. Student loans can be used to pay for your housing costs, including living off-campus in an apartment. In addition to rent, you can also use your student loans to pay for utilities.

Can I use my student loan for living expenses?

You can use your student loans for basic living expenses related to your education. This includes housing on-campus and off-campus; food such as your college meal plan or groceries; and transportation to and from school. You cannot use student loans for expenses like movie tickets, streaming services, vacations, or gym memberships.

What can student loans be used for?

Student loans can be used to pay for expenses related to your education, including tuition and fees, books and supplies such as a laptop or backpack, housing on-campus or off-campus, food such as a college meal plan or groceries for cooking at home, and transportation to and from college or an internship program.

Are there restrictions on how student loans are spent?

Yes. When you take out student loans, you sign a promissory note outlining the terms and conditions of the loan, including what you can and can’t spend your loan money on. Student loans are meant to be used for essential education-related expenses, such as tuition and fees, room and board, and transportation to and from school. They are not meant to be used for things like entertainment, vacations and items that are not essential to your education.

Can I use student loans for off-campus housing or utilities?

Yes, you can use student loans to pay for off-campus housing costs like rent and utilities. These are considered housing expenses essential to your education.

About the author

SoFi Student Loan Refinance SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOSLR-Q225-022

Read more