The moving average is a tool that can help investors decide whether and when to buy or sell a stock. It presents a smoothed-out picture of where a stock’s price has been in the past and where it’s trending now. Investors may compute moving averages over a variety of time frames, and they are useful to both long-term and short-term investors.

What Is a Moving Average?

A moving average is a metric often used in technical analysis. For a stock, it’s a constantly updated average price.

Unlike trying to track a stock price day-to-day, a moving average smooths price volatility and is an indicator of the current direction a price is headed. A moving average reflects past prices — usually a stock’s closing price — so it’s not a predictor of future direction, just what’s happening now or in the past.

You can compute moving averages using almost any time frame. Common time frames include 20-day, 30-day, 50-day, 100-day and 200-day moving averages.

While a moving average is useful on its own when analyzing different types of investments, it also forms the basis of other types of technical indicators, such as the Moving Average Convergence Divergence (MACD) and the McClellan Oscillator.

💡 Quick Tip: If you’re opening a brokerage account for the first time, consider starting with an amount of money you’re prepared to lose. Investing always includes the risk of loss, and until you’ve gained some experience, it’s probably wise to start small.

Types of Moving Averages

There are three common types of moving averages that investors might consider when deciding when to buy or sell a stock:

Simple Moving Average:

As the name states, this is the simplest type of moving average. You can calculate the simple moving average by finding the arithmetic mean of a set of data points. For instance, if you had an average daily price for a stock each day for the last 30 days, you would add them all together and divide by the number of days.

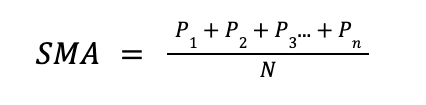

The Simple Moving Average (SMA) formula is as follows:

P = Price on a given date

n = The time period

Example: Suppose you were trying to find the simple moving average of a stock price over 10 days.

N = 10 days

Prices (in dollars) = 11, 12, 15, 13, 12, 7, 10, 11, 13, 12

SMA = (11 + 12 + 15 + 13 + 12 + 7 + 10 + 11 + 13 + 12) / 10

SMA = 11.6

Weighted Moving Average

A weighted moving average (WMA) gives more weight to certain price prices. If you overweight recent prices, for example, the measure becomes more responsive to recent price moves and less prone to the lag effect.

Exponential Moving Average:

An exponential moving average is a type of weighted moving average that calculates changes in a price cumulatively, rather than based on previous average. That means that all previous data values impact the EMA, since there is less variation over time.

Why Would an Investor Use a Moving Average?

Using a moving average to analyze a stock can help you filter out the “noise” that comes from random price fluctuations. By looking at the direction of the moving average, you can get a sense of whether the price is generally moving up or generally moving down. If a moving average is moving sideways (neither up nor down), the price is probably sticking within a window and not fluctuating much.

A moving average is sometimes plotted as a line by itself on a price chart to illustrate price trends. And different moving average lines can be used in tandem to spot changes in direction. For instance, an investor might be looking at a faster moving average (one with a shorter period, such as 10 days) versus a slower moving average (one with a longer period, such as 200 days). When these lines cross each other, it’s called a moving-average crossover, and can indicate that the trend is changing or is about to change.

Moving averages can also indicate support or resistance levels. Support levels are a price level where a downward trending line would be predicted to pause, due to demand or buying interest. A resistance level is a price ceiling where an upward trending line would be expected to plateau due to selling interest. Over time, watching moving averages can help investors identify these levels of support and resistance, and use them to make buy/sell decisions.

💡 Quick Tip: How to manage potential risk factors in a self-directed investment account? Doing your research and employing strategies like dollar-cost averaging and diversification may help mitigate financial risk when trading stocks.

Pros of Using a Moving Average

A moving average offers several benefits to investors.

It smooths the data.

Day-to-day price swings can be confusing to track, and make it difficult to determine a stock’s direction. A moving average smooths out volatility, giving you a better look at how a stock is trending.

It’s a simple gauge.

As an analytical tool, a simple moving average is easy to interpret. If a stock’s current price is higher than an upward trending moving average line, the stock is headed up in the short-term. If a stock’s price is lower than a downward trending moving average line, the stock is headed down in the short-term.

Easy to calculate.

A moving average is a relatively easy metric, so the average investor can calculate it on their own.

Cons of Using a Moving Average

It’s important to keep the drawbacks of moving averages in mind when using them to determine whether to buy shares of a company.

They’re not predictive.

As with all investments, past performance is not an indicator of future performance, so a moving average — no matter which type you use — can’t tell you what a stock will do next.

There’s a lag.

The longer the period your moving average covers, the greater your lag — meaning how responsive your moving average is to price changes. A 10-day exponential moving average, for instance, will react quickly to price turns, while a 200-day moving average is more sluggish and slower to react to changes.

There’s trouble with price turbulence.

If prices are trending in one direction or another, a moving average may be a helpful metric. But if prices are choppy or volatile, the moving average becomes less useful, since it will swing along with the price. Allowing for a lengthier time frame may resolve this issue, but it can still occur.

Simple moving averages weigh all prices equally. This can be a disadvantage if a stock’s price has taken a significant but recent shift.

Weighted moving averages may send false signals.

Since WMAs put more weight on more recent data, they’re faster to react to price swings, which can occasionally be misleading.

The Takeaway

Moving averages are just one metric you can use to evaluate a stock. They can help quiet the noise of price fluctuations and show you what a stock is doing over time. That said, in some environments or with specific price patterns, moving averages may lag or send a misleading signal.

With that in mind, knowing what a moving average is can be helpful when learning how to size-up potential investments. It’s critical to consider the pros and cons, of course, but moving averages can be another tool in an investor’s tool chest.

Ready to invest in your goals? It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

Photo credit: iStock/nilakkus

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Claw Promotion: Customer must fund their Active Invest account with at least $50 within 30 days of opening the account. Probability of customer receiving $1,000 is 0.028%. See full terms and conditions.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

SOIN0623010