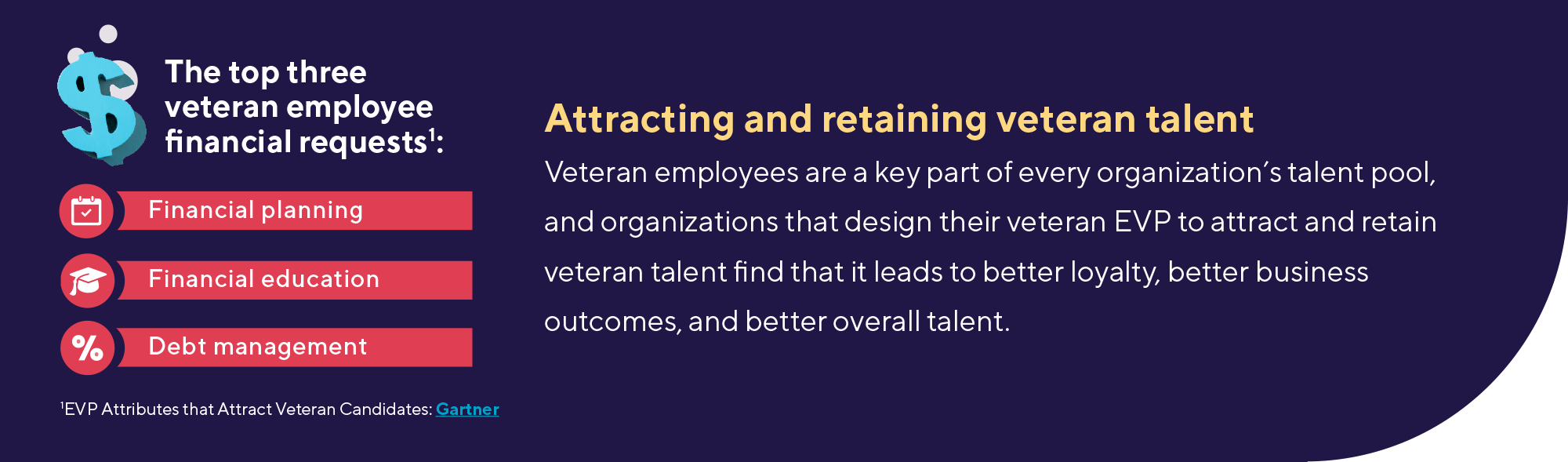

Veteran employees are a key part of every organization’s talent pool. While many companies have invested in veteran-focused employee resource groups, specialized recruitment teams, or tailored onboarding programs, one area often underutilized is financial well-being support.

While financial health is a vital consideration for all employees, veterans often face distinct challenges and circumstances as they transition from military to civilian life. Many are dealing with everyday financial issues — like budgeting, choosing workplace benefits, and planning for retirement — for the first time. Veterans may also carry significant debt, including student loans and credit card balances, and struggle with balancing short-term needs with long-term financial stability. As a result, financial education and counseling can be a critical and much-appreciated benefit for this segment of your workforce.

Here’s a look at how you can design a meaningful and impactful financial wellness program to attract, engage, and retain veteran talent.

Key Points

• Veterans often face significant financial challenges and may have lower financial literacy compared to civilians.

• Many veterans have significant student and other debt, as well as low (or no) emergency savings.

• Employers can support veterans by offering student loan repayment benefits and emergency savings plans.

• Financial education and coaching can help veterans manage budgets, reduce debt, and plan for the future.

• Employers can support retirement readiness by offering veteran-specific guidance and employer 401(k) match incentives.

Student Loan Employer Contributions

Despite having access to significant federal veterans’ education benefits, not all veterans leave the service debt-free. Indeed, more than a quarter of veteran undergraduate students have taken out private and federal student loans (with a median amount of $8,000) to complete their education, according to The Pew Charitable Trusts. Their data suggests that the majority of undergraduate student veterans borrow primarily to cover living expenses such as housing and child care. In addition, many veterans accrue student loan debt when they co-sign or take out loans for their children.

Offering student loan repayment benefits is a powerful way to demonstrate support for veterans, as well as all employees who carry student debt. One way to do this on a tax-advantaged basis is through an educational assistance program. Under current law, employers can provide up to $5,250 tax-exempt annually toward a qualified employee’s student loan repayment through 2025 (and possibly beyond, pending legislation).

Thanks to the SECURE 2.0 Act of 2022, another way employers can support workers with student debt is by making matching contributions to retirement plans based on employees’ student loan payments. The purpose of the law is to assist employees who may, because of their student loan debt, decide against making elective contributions by payroll reduction and, as a result, miss out on employer matching contributions.

Emergency Savings Programs

Veteran financial wellness also suffers among those who have less in liquid savings or feel they could not absorb an unexpected financial shock. Research indicates that around 38% of veterans have less than $500 in an emergency savings fund, or no fund at all. These numbers suggest that one way to help relieve financial stress among veteran employees is through an employer-sponsored emergency savings plan.

These plans allow employees to contribute after-tax payroll deductions automatically into a customized savings account. Many employers also make matching contributions, much as they might with a 401(k). Depending on plan design, these funds can be available at any time and for any reason. In addition, most Emergency Savings Accounts (ESAs) are portable, meaning that veterans and other employees can take advantage of the program and retain its benefits even when they have a change in employment.

Help With Credit Card Debt

Another factor that commonly impacts employee financial well-being is high-interest debt, and this may be particularly true for veterans. According to research by the nonprofit group American Consumer Credit Counseling, 41% of veterans have $5,000 or more in credit card debt, compared to only 28% of civilians; 27% have $10,000 or more in credit card debt while only 16% of civilians do; and 10% have $20,000 or more in credit card debt, compared to 7% of civilians.

For any employee carrying a substantial credit card balance, high interest charges and minimum payment structures can create a cycle of debt that’s hard to break free from. Minimum payments often barely cover the interest, which can result in years of payments with little reduction in the outstanding balance.

Here are some ways employers can help support employees having trouble getting ahead of credit card debt:

• Financial education programs: Consider offering workshops or webinars on budgeting, debt reduction strategies (like the snowball or avalanche method), and credit management. In addition, you might offer access to financial literacy platforms or tools that explain interest rates, minimum payments, and the long-term cost of debt.

• Financial coaching and credit counseling: You might partner with a local financial counselor or a nonprofit organization to offer employees free or subsidized one-on-one financial coaching and debt counseling.

• Flexible payroll options: Giving employees access to their earnings before payday in case of an emergency can help workers pay their bills on time, avoid late fees, and reduce their reliance on credit cards for everyday expenses.

Recommended: How Financial and Mental Health Can Collide With Work

Balance Short-Term Needs and Long-Term Financial Goals

Veterans often need to juggle short-term needs (like finding housing, covering moving expenses, or supporting a family) with long-term goals like retirement. Balancing these competing demands can be especially difficult if they’re dealing with debt and learning how to manage money without military infrastructure.

Employers can support retirement readiness by offering clear, veteran-specific guidance on retirement planning, including how to roll over Thrift Savings Plans, how to integrate VA disability benefits into long-term financial planning, and how to catch up on retirement savings. Employer 401(k) match incentives and targeted education on retirement investment strategies can also be especially impactful.

The Takeaway

It’s essential to analyze your workforce — and the talent you’re looking to hire — to understand what programs will best serve your veteran employees’ needs. But implementing a few hallmark veteran-ready financial well-being programs can help you improve the overall financial wellness of your workforce and attract and retain top talent.

SoFi at Work offers a benefits platform, education resources, and financial counseling that can help you increase employee productivity, loyalty, and overall well-being.

Photo credit: iStock/SDI Productions

Products available from SoFi on the Dashboard may vary depending on your employer preferences.

Advisory tools and services are offered through SoFi Wealth LLC, an SEC-registered investment adviser. 234 1st Street San Francisco, CA 94105.

SoFi Student Loan Refinance Loans, Personal Loans, Private Student Loans, and Mortgage Loans are originated through SoFi Bank, N.A., NMLS #696891 (Member FDIC), (www.nmlsconsumeraccess.org ). The 529 Savings and Selection Tool is provided by SoFi Wealth LLC, an SEC-registered investment adviser. For additional product-specific legal and licensing information, see SoFi.com/legal. 2750 E. Cottonwood Parkway #300 Cottonwood Heights, UT 84121. ©2025 Social Finance, LLC. All rights reserved. Information as of November 2025 and is subject to change.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOAW-Q225-012