If you are struggling to make payments on a personal loan and the loan goes into default, there can be negative consequences like damage to your credit score, having the loan turned over to a collection agency, and legal repercussions. Learn more about this situation and what your options are.

Key Points

• Defaulting on a personal loan can result in late fees, credit score damage, and legal actions like wage garnishment or property liens.

• A personal loan default can severely harm your credit score, affecting future credit opportunities and lasting up to seven years on your credit report.

• When a personal loan goes into default, the process can involve fees, notification of credit bureaus, and aggressive collection efforts.

• To avoid default, reassess your budget, negotiate with your lender for better terms, and/or explore refinancing options.

• When selecting a new lender, evaluate borrowing limits, interest rates, fees, and additional benefits.

What Does It Mean to Default on a Personal Loan?

Just as with a mortgage or student loans, defaulting on a personal loan means you’ve stopped making payments according to the loan’s terms. You might be just one payment behind, or you may have missed a few. The point at which delinquency becomes default with a personal loan — and the consequences — may vary depending on the type of loan you have, the lender, and the loan agreement you signed.

How Does Loan Default Work?

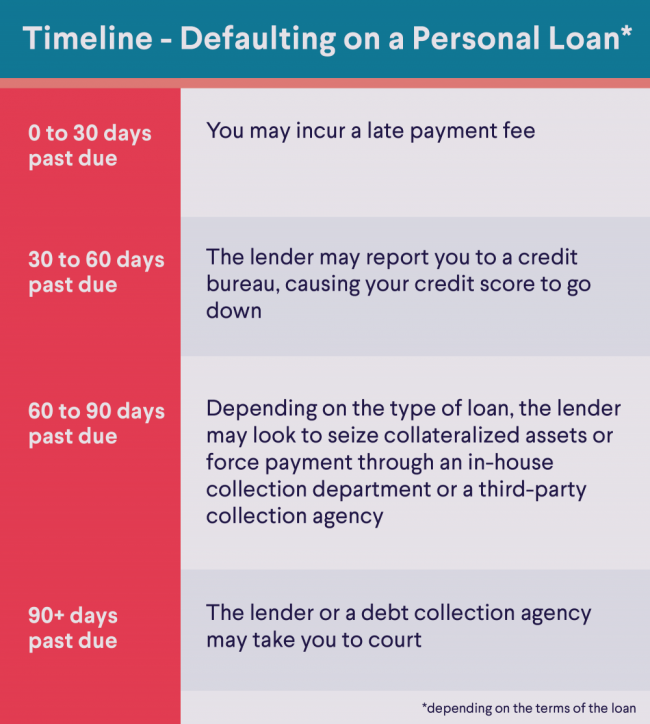

Even if you miss just one payment on a personal loan, you might be charged a late fee. Your loan agreement should have information about when this penalty fee kicks in — it might be one day or a couple of weeks — and whether it will be a flat fee or a percentage of your monthly payment.

The agreement also should tell you when the lender will get more serious about collecting its money. Because the collections process can be costly for lenders, it might be a month or more before yours determines your loan is in default. But at some point, you can expect the lender to take action to recover what they’re owed.

What Are the Consequences of Defaulting on a Personal Loan?

Besides those nasty late fees, which can pile up fast, and the increasing stress of fretting about a debt, here are some other significant consequences to consider:

Damage to Your Credit

Lenders typically report missing payments to the credit bureaus when borrowers are more than 30 days late. This means your delinquency will likely show up on your credit reports and could cause your credit scores to go down. Even if you catch up down the road, those late payments can stay on your credit reports for up to seven years.

If you actually default and the debt is sold to a collection agency, it could then show up as a separate account on your credit reports and do even more damage to your credit scores.

Though you may not feel the effects of a lower credit score immediately, it could become a problem the next time you apply for new credit — whether that’s for a credit card, car loan, or mortgage loan. It could even be an issue when you try to rent an apartment or need to open new accounts with your local utilities.

Sometimes, a lender may still approve a new loan for borrowers with substandard credit scores, but it might be at a higher interest rate. This means you’d pay back more interest over the life of the loan, which could set you back even further as you work toward financial wellness.

Dealing with Debt Collectors

If you have a secured personal loan, the lender may decide to seize the collateral you put up when you got the loan (your car, personal savings, or some other asset). If it’s an unsecured personal loan, the lender could come looking for payment, either by working through its in-house collection department or by turning your debt over to a third-party collection agency.

Even under the best conditions, dealing with a debt collector can be unpleasant, so it’s best to avoid getting to that stage if you can. But if you fall far enough behind to be contacted by a debt collector, you should be prepared for some aggressive behavior on the part of the collection agency. These agents may have monthly goals they must meet, and they could be hoping you’ll pay up just to make them go away.

There are consumer protections in place through the Fair Debt Collection Practices Act that clarify how far third-party debt collectors can go in trying to recover a debt. There are limits, for example, on when and how often a debt collector can call someone. And debt collectors aren’t allowed to use obscene or threatening language. If you feel a debt collector has gone too far, you can file a complaint with the Consumer Financial Protection Bureau (CFPB).

You Could Be Sued

If at some point the lender or collection agency decides you simply aren’t going to repay the money you owe on a personal loan, you eventually could end up in court. And if the judgment goes against you, the consequences could be wage garnishment or, possibly, the court could place a lien on your property.

The thought of going to court may be intimidating, but failing to appear at a hearing can end up in an automatic judgment against you. It’s important to show up and to be prepared to state your case.

A Cosigner Could Be Affected

If you have a co-applicant or cosigner on your personal loan, they, too, could be affected if you default.

When someone cosigns on a loan with you, it means that person is equally responsible for paying back the amount you borrowed. So if a parent or grandparent cosigned on your personal loan to help you qualify, and the loan goes into default, the lender — and debt collectors — may contact both you and your loved one about making payments. And your cosigner’s credit score also could take a hit.

Is There a Way to Avoid Defaulting on a Loan?

If you’re worried about making payments and you think you’re getting close to defaulting — but you aren’t there yet — there may be some things you can do to try to avoid it.

Reassessing Your Budget

Could you maybe squeak by and meet all your monthly obligations if you temporarily eliminated some expenses? Perhaps you could put off buying a new car for a bit longer than planned. Or you might be able to cut down on some discretionary expenses, such as dining out and/or subscription services.

This process may be a bit painful, but you can always revisit your budget when you get on track financially. And you may even find there are things you don’t miss at all.

Talking to Your Lender

If you’re open about your financial issues, your lender may be willing to work out a modified payment plan that could help you avoid default. Some lenders offer short-term deferment plans that allow borrowers to take a temporary break from monthly payments if they agree to a longer loan term.

You won’t be the first person who’s contacted them to say, “I can’t pay my personal loan.” The lender likely has a few options to consider — especially if you haven’t waited too long. The important thing here is to be clear on how the new payment plan might affect the big picture. Some questions to ask the lender might include: “Will this change increase the overall cost of the loan?” and “What will the change do to my credit scores?”

Getting a New Personal Loan

If your credit is still in good shape, you could decide to get proactive by looking into refinancing the personal loan with a new one that has terms that are more manageable with your current financial situation. However, be sure to factor in any fees (such as origination fees on the new loan and/or a prepayment penalty on the old loan) to make sure the refinance will save you money. You’ll also want to keep in mind that extending the term of the term of your loan can increase the cost of the loan over time.

You can use an online personal loan calculator to see how much interest you might be able to save by paying off your existing debt with a loan.

Or you might consider combining the old loan and other debts into one debt consolidation loan with a more manageable payment. This strategy would be part of an overall plan to get on firmer financial footing, of course. Otherwise, you could end up in trouble all over again.

But if your income is higher now and/or your credit scores are stronger than they were when you got the original personal loan, you could potentially improve your interest rate or other loan terms. (Personal loan requirements vary by lender.) Or you might be able to get a fresh start with a longer loan term that could potentially lower your payments.

If you decide a new personal loan is right for your needs, the next step is to choose the right lender for you. Some questions to ask lenders might include:

• Can I borrow enough for what I need?

• What is the best interest rate I can get?

• Can I get a better rate if I sign up for automatic payments?

• Do you charge any loan fees or penalties?

• What happens if I can’t pay my personal loan because I lost my job? Do you offer unemployment protection?

Is There a Way Out of Personal Loan Default?

Even if it’s too late to avoid default, there are steps you may be able to take to help yourself get back on track. After carefully evaluating the situation, you may decide you want to propose a repayment plan or lump-sum settlement to the lender or collection agency. If so, the CFPB recommends being realistic about what you can afford, so you can stick to the plan.

If you need help figuring out how to make it work, the CFPB says, consulting with a credit counselor may help. These trained professionals can work with you to come up with a debt management plan. While a counselor usually doesn’t negotiate a reduction in the debts you owe, they might be able to help get your interest rates lowered or have loan terms extended, which could lower your monthly payments.

What’s more, a credit counselor can also help you create a budget, advise you on managing your debts and money, and may even often offer free financial education workshops and resources.

But consumers should be cautious about companies that claim they can renegotiate, settle, or change the terms of your debt. The CFPB warns that some companies promise more than they can deliver. If you’re interested in exploring credit counseling, a good place to start is browsing this list of nonprofit agencies that have been certified by the Justice Department.

Finally, as you make your way back to financial wellness, it can be a good idea to keep an eye on two things:

1. The Statute of Limitations

For most states, the statute of limitations — the period during which you can be sued to recover your debt — is about three to six years. If you haven’t made a payment for close to that amount of time — or longer — you may want to consult a debt attorney to determine your next steps. (Low-income borrowers may even be able to get free legal help.)

2. Your Credit Score

Tracking your credit reports — and seeing first-hand what builds or hurts your credit scores — could provide extra incentive to keep working toward a healthier financial future. You can use a credit monitoring service to stay up to date, or you could take a DIY approach and check your credit reports yourself. Every U.S. consumer is entitled to free credit reports available at AnnualCreditReport.com, which is a federally authorized source.

The Takeaway

If you default on a personal loan, there can be various negative impacts, such as a lower credit score, owing fees, and having your debt turned over to a collection agency. If you’re struggling to make payments, you might proactively talk to your current lender about modified payment terms — or it might be time to consider a new personal loan to consolidate high-interest debt.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

FAQ

How bad is it to default on a personal loan?

When a loan goes into default, it can trigger fees, damage your credit score, and stay on your credit report for up to seven years. You could face legal action as well. These negative consequences can mean it’s harder to qualify for new credit or do so at a favorable rate.

What happens if I don’t pay back a personal loan?

While the exact consequences will vary depending on your loan and your lender, typically, when you don’t pay back a personal loan, your credit score will be negatively impacted, you may face collection efforts from an agency or the lender, and you could also face legal action.

Is it a crime to default on a loan?

It isn’t a crime to default on a loan. You cannot be arrested. However, you could face legal action and have to appear in court in connection with the non-payment of the debt.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

This article is not intended to be legal advice. Please consult an attorney for advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOPL-Q325-046